More Than 180 Million Bank Accounts Have Been Established in Vietnam - Opportunities for The Development of Remittances to Vietnam.

Vietnam's financial landscape has witnessed a remarkable transformation in recent years. One of the most significant milestones in this evolution is the establishment of more than 180 million bank accounts across the country (in 2023).

This impressive number is not only a testament to the rapid development of Vietnam's banking sector but also presents a myriad of opportunities for the growth of remittances to Vietnam.

In this blog, we will explore the implications of this development and how it paves the way for a more robust and efficient remittance ecosystem.

The Rise of Bank Accounts in Vietnam

Overview of the Growth of Personal Bank Accounts in Vietnam

As discussed in our previous article on the development of payment methods in Vietnam from the post-reunification period to the present, banks began integrating into the Vietnamese economy during the 1980s and 1990s.

However, their entry was marked by immense pressure due to the country's hyperinflation, which soared to over 800% by the late 1980s.

It wasn't until the 2000s, after Vietnam reopened its economy and began to grow following the lifting of the US embargo, that banks started to flourish.

Since then, banks have developed significantly through various stages, becoming formidable competitors to Vietnam's electronic wallets.

Factors Driving Growth of Personal Bank Accounts in Vietnam

Economic Development: As Vietnam's economy has grown, so has the need for banking services. Rising incomes and increased business activities have spurred the demand for personal bank accounts.

Financial Inclusion: Government and private sector initiatives have aimed at bringing more people into the formal banking system. Programs targeting rural and underserved areas have been particularly successful, providing banking access to millions who previously relied on informal financial services.

Technological Advancements: The adoption of digital banking has played a crucial role in the growth of personal bank accounts. Mobile banking apps, online account management, and other digital services have made banking more accessible and convenient.

Regulatory Support: The Vietnamese government has implemented policies to support the banking sector's growth, including regulations to enhance financial stability, protect consumers, and encourage innovation.

Opportunities for Remittances to Vietnam

Enhanced Accessibility of Remittances to Vietnam Process

Before the Growth of Bank Accounts in Vietnam the Growth of Bank Accounts in Vietnam and Digital Money Transfer

Transferring remittances from abroad to Vietnam involves several complex stages to ensure the money reaches its intended recipient securely and efficiently and takes too much money and time from senders and recipients (often extend beyond one week of working days).

Step 1: Initiation

The sender chooses a remittance service provider, which could be a bank, a money transfer operator (such as Western Union or MoneyGram).

Then the sender provides identification and other necessary documents as required by the service provider for verification purposes to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

The sender provides the recipient’s details, including name, address,...

Step 2: Sending the Money

The sender makes the payment to the service provider. This can be done through various means such as cash, bank transfer, or credit/debit card.

The service provider charges a fee for the transfer, which varies depending on the amount, destination, and the provider's policies.

The remittance amount is often converted from the sender’s local currency to Vietnamese dong (VND). Exchange rates and additional fees may apply.

Step 3: Processing by Intermediaries

The money is processed through financial networks and possibly multiple intermediary banks. This stage involves compliance checks and may cause delays depending on the networks involved.

The transaction undergoes clearing and settlement processes to ensure funds are correctly transferred and accounted for.

Step 4: Receipt in Vietnam

The recipient’s bank or money transfer operator receives the funds. They may notify the recipient through various channels such as SMS, email, or a phone call.

The receiving entity conducts additional compliance checks to adhere to local regulations and prevent fraud.

Step 5: Disbursement to the Recipient

The transfer is made for cash pickup, the recipient can collect the money from designated pickup locations, which could include banks or remittance service provider branches. The recipient will need to provide identification and a transaction reference number.

After the Growth of Bank Accounts in Vietnam and Digital Money Transfer

Transferring remittances from abroad to Vietnam involves several simpler stages and still ensures the money reaches its intended recipient securely and efficiently.

Step 1: Initiation

The sender chooses a remittance service provider, which could be a bank, a money transfer operator (such as Western Union or MoneyGram), or an online remittance platform.

Then the sender provides identification and other necessary documents as required by the service provider for verification purposes to comply with anti-money laundering (AML) and know your customer (KYC) regulations.

The sender provides the recipient’s details, including name, address, and bank account information if the transfer is to a bank account.

Senders also can complete this process from the comfort of their homes using their phones and any money transfer app like Remitly, Ria Money Transfer, Sendwave. These apps allow users to perform all necessary steps directly from their mobile devices.

Step 2: Sending the Money and Processing by Intermediaries

The sender makes the payment to the service provider. This can be done through various means such as cash, bank transfer, or credit/debit card.

The service provider charges a fee for the transfer, which varies depending on the amount, destination, and the provider's policies.

That can be cheaper or sometimes free when using some remittance apps or websiteslike Remitly, Ria Money Transfer, Sendwave.

The remittance amount is often converted from the sender’s local currency to Vietnamese dong (VND). Exchange rates and additional fees may apply.

The money is processed through financial networks and possibly multiple intermediary banks. This stage involves compliance checks and may cause delays depending on the networks involved.

The transaction undergoes clearing and settlement processes to ensure funds are correctly transferred and accounted for.

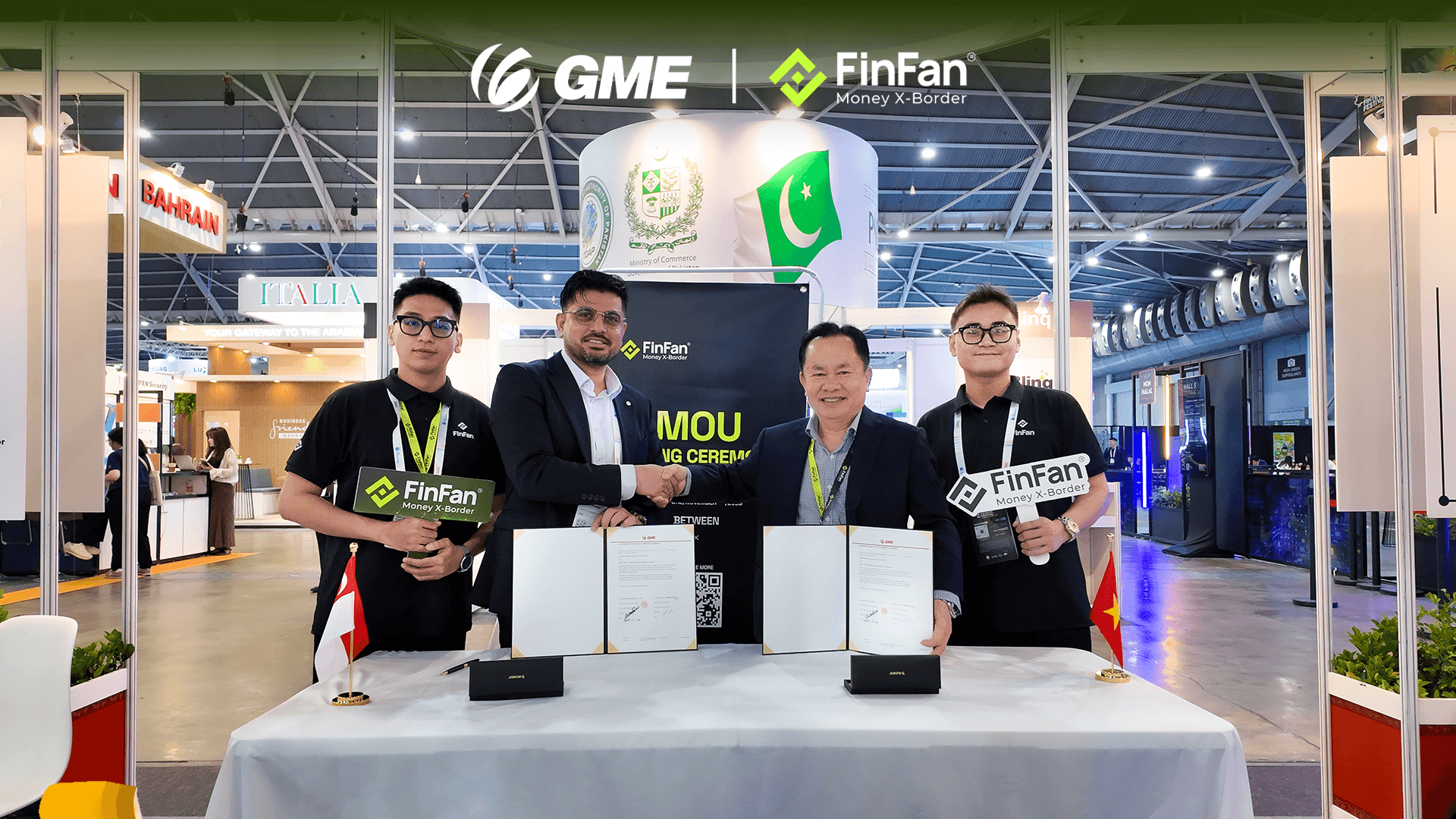

In this combined step, the transfer goes through several intermediaries before reaching Vietnam (including the intermediary remittance connection, collection, and disbursement service to Vietnam, such as FinFan).

However, we have consolidated steps 2 and 3 because the actions related to linking the sender's bank and conducting compliance checks are entirely performed digitally when using international remittance apps.

Furthermore, when transferring to a bank account in Vietnam, especially to a bank within the NAPAS system, the process of verifying whether the account complies with Vietnamese legal regulations is also carried out entirely digitally using AI and Big Data technologies.

Step 3: Receipt in Vietnam and Disbursement to the Recipient

At this point, recipients in Vietnam can directly receive funds through two methods:

- Receive directly into their bank accounts after passing compliance checks to adhere to regulations of the State Bank of Vietnam regarding fraud prevention and anti-money laundering measures, facilitated by intermediary remittance collection and disbursement services like FinFan in collaboration with NAPAS.

- Receive funds directly into their e-wallet accounts if the sender opts for this method, making it convenient as most e-wallets are directly linked to phone numbers, simplifying the processing through FinFan's e-wallet aggregator product.

Read more:

. There Will Be 50 Million E-Wallets Operating in the Vietnamese Market This Year (2024)

Conclusion Regarding the Relationship between the Development of Bank Accounts and the Growth of Digital Remittance to Vietnam

The symbiotic relationship between the development of bank payment accounts and the growth of digital remittances underscores a transformative shift in how financial transactions are conducted in Vietnam.

This integration of banking infrastructure with digital innovations not only enhances financial inclusion but also drives economic growth and resilience in an increasingly connected global economy.

As technology continues to advance and regulatory frameworks evolve, the trajectory of digital remittances to Vietnam is poised for continued expansion, benefiting both senders and recipients alike.

This article was curated and authored by FinFan's market research and development team, alongside our marketing department.

About FinFan

FinFan is a cross-border embedded financial services company that focuses on mass disbursement, fund collection, card processing, IBAN, and digital APMs solutions, which can provide valuable input and integration on and for the same.

FinFan is already integrated with almost the world's well-known MTOs, PSPs, switch, and core fintech platforms such as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal, Ripple, TripleA, FoMo Pay, Wings, etc.

For more information, please get in touch with us through:

🌐https://finfan.io

📞(+84) 2866 85 3317

✉ support@finfan.vn

LinkedIn: FinFan