Relaxation of Regulations on Remittances to Vietnam- What Form Will Real Estate Investment Capital Inflows Take?

In previous articles, FinFan has mentioned the new relaxed regulations allowing overseas Vietnamese to own real estate in Vietnam.

In this article, let’s explore with FinFan the channels through which remittance capital will flow into the Vietnamese real estate sector and its potential impact on the real estate market in Vietnam.

The Changing Regulatory Landscape

Historically, overseas Vietnamese (Việt kiều) faced numerous challenges in owning real estate in their homeland.

However, the government’s recent relaxation of regulations marks a significant shift. By easing restrictions, the government aims to attract more remittances and channel them into productive sectors, especially real estate.

This move is anticipated to bolster the market, providing a fresh influx of capital that can stimulate economic growth and development.

Expected Channels for Real Estate Investment

With the new regulations in place, several potential avenues for real estate investment are likely to emerge:

- Residential Properties: Overseas Vietnamese may now find it more appealing to invest in residential properties, including apartments and villas. The demand for high-end housing, especially in urban areas like Ho Chi Minh City and Hanoi, could see a significant boost.

- Commercial Real Estate: With remittances flowing more freely, there may be an increased interest in commercial properties, such as office spaces, shopping centers, and hotels. This could be a key driver for the development of business hubs in emerging cities.

- Land Acquisition: The easing of regulations might also encourage more Việt kiều to invest in land, particularly in rapidly developing regions. This could lead to a surge in land prices, benefiting local economies.

- Real Estate Development Projects: Large-scale development projects, including residential complexes and mixed-use developments, could see increased funding from remittances. This influx of capital could accelerate the completion of such projects, adding more dynamism to the market.

Some Real Estate Segments that Overseas Vietnamese Are Not Keen On

Although Vietnam's real estate market has been a significant area of interest for overseas Vietnamese, especially with the recent relaxation of ownership regulations, not all segments of the market appeal equally to this group of investors.

Low-End Residential Properties

While the demand for residential properties is high among overseas Vietnamese, their interest often skews towards mid-range to luxury segments. Low-end residential properties, typically located in less developed areas or offering fewer amenities, are less appealing.

Reasons for Reluctance:

- Return on Investment (ROI): Low-end properties often have lower appreciation rates and rental yields, making them less attractive for investors looking for higher returns.

- Perceived Quality: The quality of construction, materials, and design in low-end properties may not meet the expectations of overseas Vietnamese, who are accustomed to higher living standards.

Agricultural Land

Vietnam's vast agricultural potential is well-known, but this segment of the real estate market sees little interest from overseas Vietnamese. Despite the potential for profit in agricultural ventures, this type of investment remains less attractive.

Reasons for Reluctance:

- Complex Regulations: Ownership and use of agricultural land come with strict regulations in Vietnam, including limitations on land use changes and long-term leases. Navigating these legalities can be challenging for overseas investors.

- High Maintenance and Management Costs: Managing agricultural land, especially from abroad, can be costly and time-consuming, requiring a significant amount of local knowledge and resources.

Industrial Properties

With the booming manufacturing sector in Vietnam, industrial properties, such as factories and warehouses, offer substantial opportunities. However, these are not the first choice for many overseas Vietnamese investors.

Reasons for Reluctance:

- Specialized Knowledge: Investing in industrial properties often requires specific knowledge of the sector, including understanding zoning laws, logistics, and the industrial supply chain. Many overseas Vietnamese lack the expertise or connections needed to manage these investments effectively.

- Market Volatility: The industrial sector can be subject to fluctuations in demand, influenced by global economic conditions. This volatility can be a deterrent for investors seeking more stable, long-term returns.

Rural and Suburban Real Estate

Rural and suburban properties, often seen as affordable alternatives to urban real estate, attract little attention from overseas Vietnamese.

Reasons for Reluctance:

- Lower Market Liquidity: Rural and suburban areas generally have less market activity, making it harder to sell properties quickly or at a desired price.

- Limited Amenities: These areas may lack the infrastructure, services, and amenities found in urban centers, making them less attractive for personal use or as rental investments.

Special-Purpose Properties

Special-purpose properties, such as schools, hospitals, or religious buildings, are niche markets with limited appeal to overseas Vietnamese investors.

Reasons for Reluctance:

- High Entry Barriers: Investing in special-purpose properties often requires significant capital, along with navigating complex regulations and securing permits.

- Limited Market: The market for special-purpose properties is narrow, with fewer potential buyers or tenants, making it a riskier investment.

Condotels, or condominium hotels

Condotels, or condominium hotels, represent a unique segment of the real estate market that has gained attention in Vietnam in recent years. However, this segment also faces a mixed reception among overseas Vietnamese investors.

Reasons for Reluctance:

- Uncertain Legal Framework: The legal status of condotels in Vietnam has been a source of concern for investors.

While the government has made strides in clarifying ownership rights for condotels, uncertainties remain, particularly regarding the issuance of land use rights certificates and the duration of ownership.

These legal ambiguities can make overseas investors hesitant, as they seek clear and secure investments.

- Profitability Concerns: Condotels often promise high rental yields and the convenience of management services.

However, the reality can be different. The profitability of condotels is closely tied to the success of the associated hotel or resort operations.

If the management is not up to par or if the tourism market experiences a downturn, the expected returns can diminish significantly. This unpredictability in income can deter overseas Vietnamese from investing in condotels.

- Market Saturation: In popular tourist destinations like Da Nang, Nha Trang, and Phu Quoc, the rapid development of condotels has led to concerns about market saturation.

An oversupply of condotel units can drive down rental prices and occupancy rates, making it harder for investors to achieve their financial goals.

Overseas Vietnamese investors, who may not have the same level of on-the-ground knowledge as local investors, might be particularly wary of entering a crowded market.

- Management and Maintenance Challenges: While condotels offer the convenience of professional management, they also come with challenges.

The quality of management services can vary widely, affecting both the rental income and the long-term value of the property. Additionally, maintenance fees for condotels can be high, and investors may feel they have less control over these costs compared to owning a standalone property.

For overseas Vietnamese, who are often managing their investments from afar, these factors can be significant deterrents.

- Limited Personal Use: Unlike traditional residential properties, condotels are designed primarily as investment properties, with limited opportunities for personal use.

While some investors may appreciate the potential for rental income, others may be less enthusiastic about owning a property they can rarely enjoy themselves. This limited personal utility can make condotels less appealing to overseas Vietnamese who are looking for a property they can both use and profit from.

Impact on the Real Estate Market

The relaxation of remittance regulations is expected to have several positive effects on the Vietnamese real estate market:

- Increased Market Liquidity: With more capital flowing into the market, liquidity will likely improve, making it easier for investors to buy and sell properties.

- Price Stability: While an influx of capital could drive up property prices, the increased supply from new developments might balance this out, leading to greater price stability in the long run.

- Enhanced Urbanization: As more remittances to Vietnam are invested in real estate, urban areas could see rapid development, contributing to the country’s overall urbanization strategy.

- Economic Growth: The real estate sector's growth, fueled by remittances, could have a ripple effect on the broader economy, creating jobs and stimulating other industries.

Conclusion Regarding Relationship between the Relaxation of Regulations on Remittances to Vietnam and Form Will Real Estate Investment Capital Inflows Take

The relaxation of regulations on remittances to Vietnam presents a unique opportunity for the country’s real estate market.

As capital inflows increase, the market is poised for significant growth and transformation. Investors, both local and overseas, should closely monitor these developments to capitalize on the emerging opportunities.

With the right strategies, these changes could lead to a more vibrant and resilient real estate sector in Vietnam, benefitting not only investors but the broader economy as well.

This article was curated and authored by FinFan's market research and development team, alongside our marketing department.

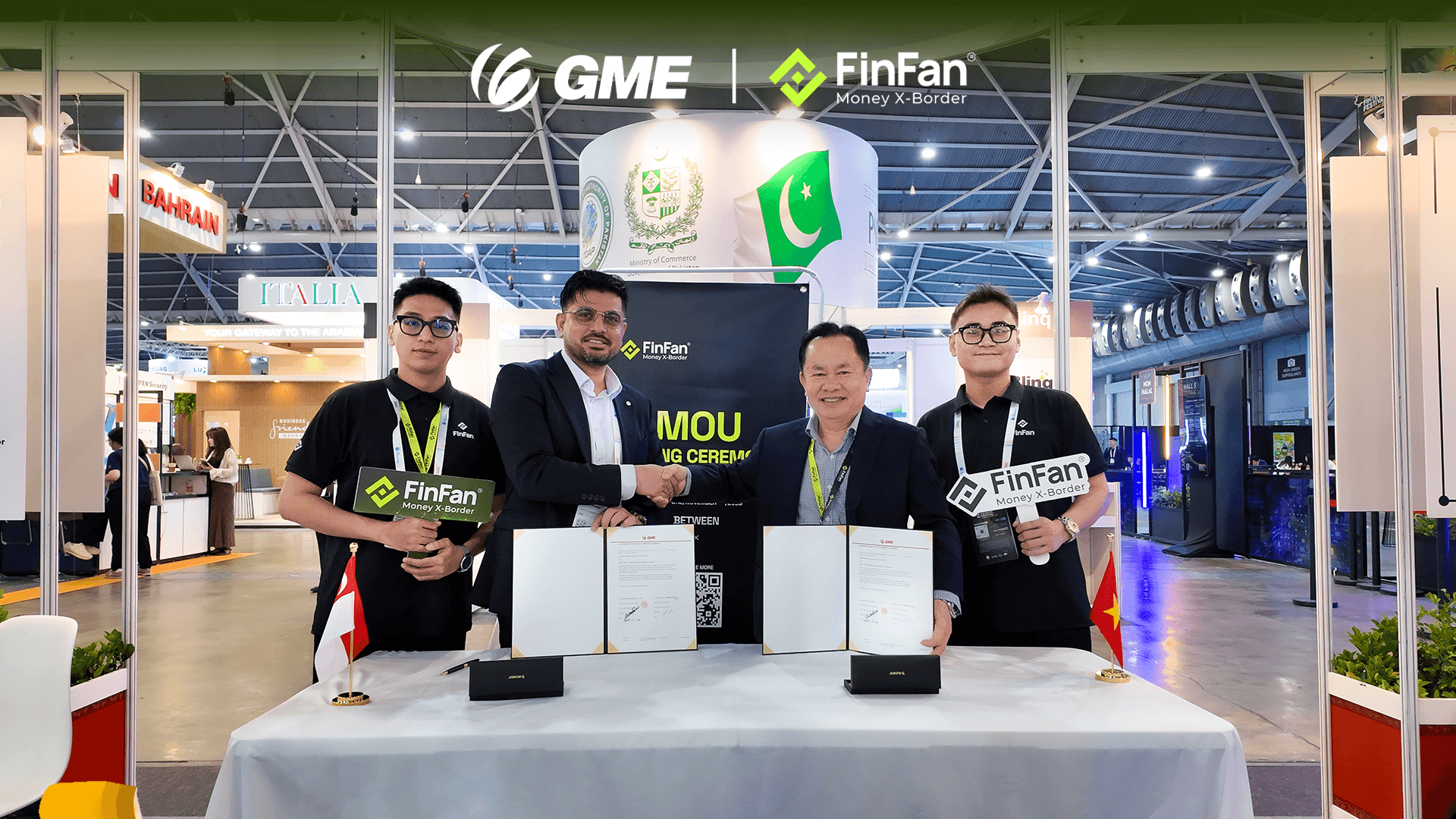

About FinFan

FinFan is a cross-border embedded financial services company that focuses on mass disbursement, fund collection, card processing, IBAN, and digital APMs solutions, which can provide valuable input and integration on and for the same.

FinFan is already integrated with almost the world's well-known MTOs, PSPs, switch, and core fintech platforms such as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal, Ripple, TripleA, FoMo Pay, Wings, etc.

For more information, please get in touch with us through:

🌐https://finfan.io

📞(+84) 2866 85 3317

✉ support@finfan.vn

LinkedIn: FinFan