Vietnam Remittance - Why has this number continuously reached records in recent years

In recent years, the remittance industry has always been one of the industries that attract the most cash flow to Vietnam, as it continues to set new records, with the total amount of money transferred to Ho Chi Minh in 2023 being the highest compared to the previous years (nearly 1.5 times higher than in 2022).

In the same year, 2022, Vietnam has risen to the top ten in the world in terms of remittances, with 19 billion USD by 2022.

Why has this number of Vietnam remittances continuously reached records in recent years? Let's find out with FinFan through this article.

Vietnam remittance - potential and development

Although Vietnam is still a developing country, with the pivot of the world economy towards the Asia Pacific region, Vietnam's economy in particular, and the entire Southeast region Asia, in general, is still in the eyes of international giants with the expectation of becoming the next dragon of the region after Taiwan, Korea, China, and Japan.

For that reason, FDI capital into the Vietnamese market is increasing year by year according to the latest statistics from the Ministry of Planning and Investment of Vietnam.

Along with that, overseas Vietnamese from all over the world are also continuously increasing the number of remittances sent to Vietnam with the need to first build a life for their relatives and then invest in some valuable assets in Vietnam such as real estate and stocks.

That's why the number of remittances continues to increase every year (except for 2022 due to the impact of the economic recession). Even by 2023, the calculated amount of remittances sent to only Ho Chi Minh reached an impressive milestone and continuously broke records when reaching nearly 1.5 times that of 2022.

Factors affecting Vietnam remittance.

The vibrant labor market of some developed countries in Asia is the first factor affecting Vietnam remittance.

After a difficult and volatile economic year when Russia sparked the attack on Ukraine, by 2023, the world economy, although still growing quite slowly, has gradually entered a recovery state (especially developed Asian countries that were less affected by the war), countries are expanding their need to recruit labor from abroad, especially with abundant labor resources such as Vietnam.

That is shown through the index in 2022 alone, Vietnam has reached the top 10 in the world with a total remittance amount of up to 19 billion USD.

This number is also increasing continuously when just in 2023, the amount of remittances to Ho Chi Minh City was 3 times the amount of FDI invested in the city.

The second factor affecting Vietnam remittance is the changing policies of the Vietnamese government.

As mentioned above, the original purpose of remittances sent to Vietnam was to improve the lives of relatives and relatives of Vietnamese people working away from home.

However, over time, the goals of these overseas Vietnamese have upgraded. At this time, they need to be granted some types of assets that local Vietnamese people can own such as stocks and real estate. Therefore, they need supportive policies from the government to allow the above problem to occur.

Understanding the above problem, the Vietnamese government has made some changes in land law, specifically as follows:

*“The provisions of the Law on Land, Housing and Real Estate Business have been approved to create a unified and synchronous approach to ensure that Vietnamese people residing abroad still retain Vietnamese nationality and have the right to use land and real estate business rights like domestic citizens.

The new Land Law stipulates that Vietnamese citizens residing abroad are Vietnamese citizens with full rights related to land, not just rights to residential land like Vietnamese citizens in the country.

With the new regulations, overseas Vietnamese are allowed to invest in housing construction, construction projects for sale, lease, lease purchase, and technical infrastructure investment in real estate projects (for transfer, lease), subleasing land use rights with technical infrastructure).

The Law on Real Estate Business takes effect from January 1, 2025, with many new contents, which expands to welcome overseas Vietnamese who want to invest in real estate in Vietnam. Accordingly, Vietnamese people residing abroad are Vietnamese citizens (Vietnamese nationality) and have the same rights and obligations related to land as Vietnamese citizens in the country (that is, they can do real estate business like citizens in the country).

Particularly for people of Vietnamese origin residing abroad who are not Vietnamese citizens (do not hold Vietnamese nationality), they are only allowed to do real estate business according to the forms according to current law.

The above regulations are consistent with the Housing Law (amended), which stipulates that according to the instructions, Vietnamese residing abroad who are allowed to enter the country can own housing associated with land use rights according to land law.

Thus, the provisions of the three passed laws are basically unified and synchronized, to ensure that overseas Vietnamese still retain Vietnamese nationality and have land use rights and business rights in Vietnam like domestic citizens.”*

*Source: CafeF

The final factor affecting Vietnam remittance is the development of cross-border money transfer technology.

As the previous article talked about the factors that determine the choice of a remittance company to transfer money to Vietnam, the development of cross-border money transfer technology has become a prerequisite when it addresses 2 problems, the very basic demands of transferring remittances to Vietnam are fast and low cost.

Not only that, the convenience that cross-border money transfer technologies bring to users in Vietnam is also an important factor affecting the decisions of international senders.

See the following stories to feel the convenience of applying technology to money transfers when:

. send money from the UK to Vietnam

. make foreign remittances from the U.S. to Vietnam

. make remittances from Japan to Vietnam

FinFan - stay ahead of technology trends by upgrading systems and products related to Vietnam remittance with international partners

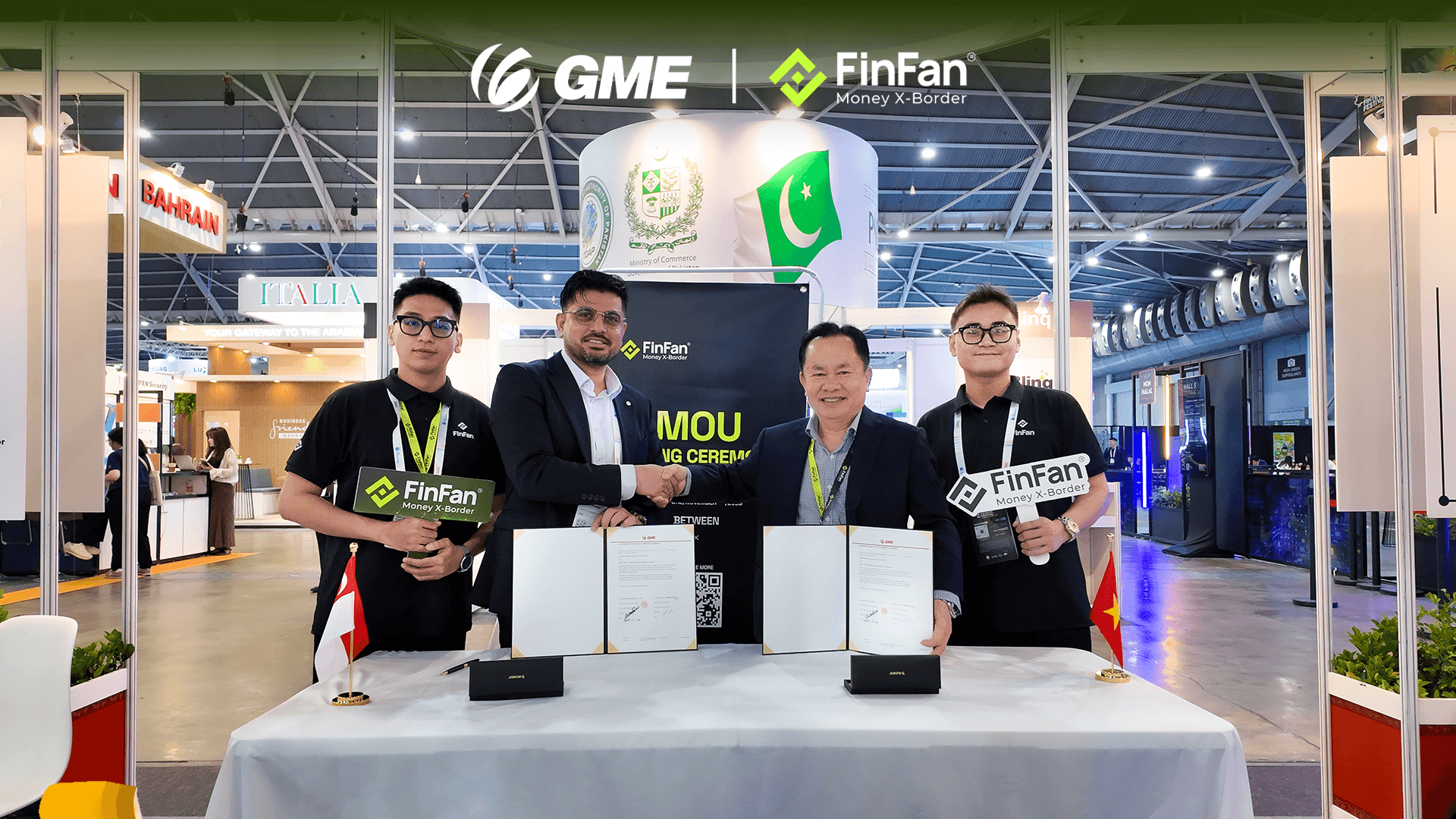

Understanding the common psychology of potential customers, FinFan has cooperated with many foreign partners to promote the development of cross-border money transfer technology.

One of those partners is Ria Money Transfer when FinFan has combined with this unit specializing in remittance money transfer services to Vietnam in all fields of the latest technology including:

- Direct API connection to e-wallet partners through FinFan's e-wallet aggregator system helps users transfer money directly from Ria Money Transfer to ZaloPay in just 3 steps:

Step 1: Send information to your relatives abroad to log in to Ria Money Transfer

🖥 On computer: Through the website: https://www.riamoneytransfer.com

📱 Download the app on the app store:

o Appstore: search for the keyword Ria Money Transfer

o Google Play: search for the keyword Ria Money Transfer

Step 2: Make a money transfer order, then enter recipient information and select ZaloPay payment method (information must match the phone number registered to the reciepient's ZaloPay account).

Step 3: Complete the money transfer order and the money will be transferred directly to the recipient's ZaloPay account.

- Direct API connection to Vietnamese domestic banking partners

FinFan links directly with NAPAS and Citad to support connection of more than 60 domestic banks or branches of international banks in Vietnam. With our collection and payment service, customers' remittances are transferred directly in real-time to the recipient's bank account in Vietnam. From there, the recipient will no longer need to wait several days to receive money from their friends or relatives abroad.

About Ria Money Transfer

With a worldwide network of 507,000 locations in 160 countries, Ria Money Transfer continue to make the world a smaller place by closing distances between families and their loved ones through world-class money transfers.

They also offer bill payment, mobile top-ups, prepaid debit cards, check cashing, and money orders. With every service that they provide, we work hard to provide the most positive experience possible.

About FinFan

FinFan is a cross border embedded financial services company that focuses on mass disbursement, fund collection, card processing, IBAN, digital APMs solutions, can provide valuable input and integration on and for the same.

FinFan already integrated with almost the world's well-known MTOs, PSPs, switch and core fintech platforms as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal, Ripple, TripleA, FoMo Pay, Wings, or Zalo.