Top 10 fintech companies in Southeast Asia

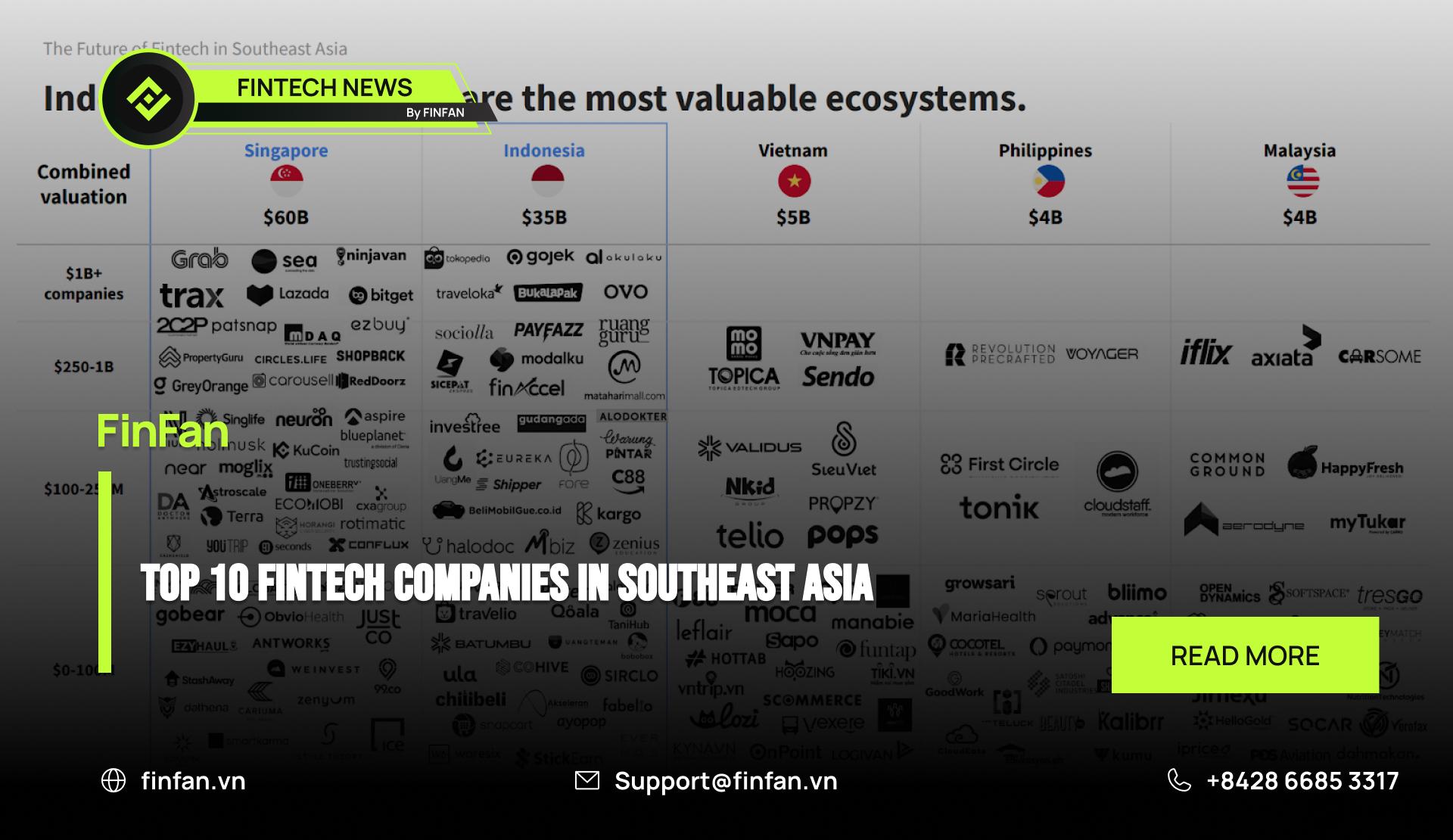

Southeast Asia - the next dragon of the world about economic growth rate and attracting international investment – is always a lucrative market for investors, especially in the technology field and particularly fintech.

What are the top 10 fintech companies in Southeast Asia? FinFan will let you know in this essay.

With six companies, Singapore is the most represented nation in Southeast Asia this year, followed by the Vietnam and Indonesia, neck to neck with two companies each.

Coda Payment – the provider of cross-border monetization solutions for digital products and services – Singapore – $2.5 billion

Coda was founded to help app developers and online game publishers collect payment. from customers in Southeast Asia, where customers want to purchase digital content, but simply don't have a credit card or bank account.

In early 2022, Coda Payments successfully raised 690 million USD from a group of investors (including the Singapore Government's GIC investment fund, Insight Partners and Smash Capital), thereby being valued at $2.5 billion.

This was a gift for the venture capital funds, which had been investing in this company the years before like Golden Gate Ventures (GGV). GGV's investment of over $1 million in Coda Payments was valued at over $100 million in April 2022, representing an internal rate of return (IRR) of up to 100 times.

Atome Financial – the company specializing in buy now pay later (BNPL) and consumer lending – Singapore – more than $2 billion

Atome is a leading "buy now, pay later" brand in Asia that offers a range of flexible deferred options. Launched in December 2019, Atome is now available across 10 markets in the region, and partners with over 15,000 leading online and offline retailers across different categories such as fashion, beauty, lifestyle, fitness, electronics, travel and homeware.

Atome Financial, a business unit of Advance Intelligence Group, in 2021 Atome Financial received more than $400 million in round D funding from an investor consortium managed by SoftBank Vision 2 Fund and Warburg Pincus, valuing the company. company more than 2 billion USD.

Nium - formerly known as Instarem, an embedded finance startup that serve banks, payment providers, and businesses – Singapore – cross $1 billion

Nium is a modern, modular platform for global business payments. It helps businesses simplify expansion, streamline local payments, improve customer experiences and unlock new revenue.

In 2021, Nium announced that it raised more than $200 million in Series D funding and saw its valuation rise above $1 billion.

The B2B payments sector is already hot, FinFan is also working in this field with the dream to become the pioneer of Vietnam’s international NEOBank.

VNLife - the parent company of fintech firm VNPay – Vietnam - $1 billion

Founded in 2007 and headquartered in Hanoi, VNLife is the parent company of fintech firm VNPay. A leading Vietnamese digital payment company, VNPay operates a network of nearly 200,000 locations nationwide, which accepts payments through the VNPay-POS, VNPay-QR and the VNPay-QR payment gateway.

VNLife raised US$250 million in July 2021 in a round led by General Atlantic and Dragoneer Investment Group that gave the firm a valuation of over US$1 billion.

M_Service - headquartered in Ho Chi Minh City, M_Service is the operator of MoMo – strategy cooperation with FinFan- Vietnam - $433.7 million**

Founded in 2007 and headquartered in Ho Chi Minh City, M_Service is the operator of MoMo, Vietnam’s leading mobile wallet that allows users to conduct seamless digital payments, make transfers, pay their bills, and more.

M_Service is one the most well-funded and most valuable private companies in Vietnam, having raised a total of US$433.7 million.

Xendit - a fintech company that provides payment solutions and simplifies the payment process for businesses – Indonesia - $538 million

Founded in 2014, Xendit is a fintech company that provides payment solutions and simplifies the payment process for businesses of all sizes in Indonesia, the Philippines and across Southeast Asia.

Xendit enables businesses to accept payments in various methods including direct debit, virtual accounts, credit and debit cards, e-wallets, retail outlets, and online installments, disburse payroll, run marketplaces and more, on an easy integration platform supported by 24/7 customer service.

Xendit closed a US$300 million Series D funding round in May 2022, bringing its total VC funding raised to US$538 million. Xendit is one of Indonesia’s fintech unicorn, valued at US$1 billion, according to CB Insights.

Akulaku - a banking and digital finance platform in Southeast Asia – Indonesia - $320 million

Founded in 2016, Akulaku is a banking and digital finance platform in Southeast Asia, with a presence in Indonesia, the Philippines, and Malaysia. The company aims to meet the daily financial needs of underserved customers in emerging markets through digital banking, digital financing, digital investment, and insurance brokerage services.

Akulaku has raised about US$320 million in VC funding, according to Dealroom, and is the most valuable fintech startup in Indonesia at US$2 billion, according to CB Insights.

Bolttech - an insurtech startup – Singapore – $217.2 million

bolttech is an international insurtech shaping the future of insurance. Its vision is to connect people with more ways to protect the things they value.

Bolttech has raised a total of $217.2M in funding over 3 rounds. Their latest funding was raised on Oct 17, 2022 from a Series B round.

Bolttech is funded by 11 investors. Tokio Marine and Alma Mundi Ventures are the most recent investors.

Thunes - a business-to-business (B2B) payment company – strategy cooperation with FinFan - $160 million

Thunes is a B2B cross-border payment network that enables corporations and financial institutions to move funds and provide financial services in emerging markets. Our global platform connects mobile wallet providers, banks, technology companies and money transfer operators in more than 100 countries and 60 currencies. Thunes is headquartered in Singapore with regional offices in London, Shanghai, and New York.

Thunes has raised a total of $160M in funding over 4 rounds. Their latest funding was raised on Mar 24, 2023 from a Series C round.

Thunes is funded by 6 investors. Marshall Wace and Future Shape are the most recent investors.

Nansen - an analytics platform that analyzes on-chain data, wallet labels, and blockchain entities including Ethereum, Polygon and Binance Smart Chain – around $88.2 million

Nansen is an on-chain data analysis tool on the blockchain. What stands out from competitors like CryptoQuant, Glassnode is that Nansen has a data warehouse containing millions of labeled wallets. These labels help to classify wallets based on characteristics such as making a lot of money from NFT, airdrop or even tied to each organization.

Nansen has raised a total funding of $88.2M over 3 rounds. Their latest funding round was a Series B round on Dec 16, 2021 for $75M.

This article was curated and authored by FinFan's market research and development team, alongside our marketing department.

About FinFan

FinFan is a cross-border embedded financial services company, focused on mass disbursement, collection, card processing, IBAN, digital APM solutions, able to provide valuable input and integration above and for the same purpose.

FinFan has integrated with most famous MTO, PSP, switch and core fintech platforms in the world such as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal , Ripple, TripleA, FoMo Pay, Wings or Zalo.

For more information please contact us via:

🌐https://finfan.io

📞(+84) 2866 85 3317

✉ support@finfan.vn

LinkedIn: FinFan