Remittances To Low- And Middle-Income Countries Reached 669 Billion USD – Chances to Cross-Border Payment Companies in Vietnam

Recently, an extremely positive statistic on remittances was published on Fintech News Singapore, indicating promising trends in the flow of remittances to low and middle-income countries in the regions of East Asia, South Asia, Latin America, the Caribbean, and the Pacific.

The latest data shows that Latin America and the Caribbean saw an 8 percent increase, while South Asia, East Asia, and the Pacific witnessed growth rates of 7.2 percent and 3 percent, respectively.

How does the growth in remittances to low and middle-income countries affect companies involved in cross-border payments in Vietnam? Let’s explore this with FinFan in the following article.

The Global Surge in Remittances

According to recent statistics published on Fintech News Singapore, remittance flows to regions such as Latin America and the Caribbean, South Asia, East Asia, and the Pacific have shown robust growth.

Latin America and the Caribbean experienced an 8 percent increase, while South Asia, East Asia, and the Pacific saw growth rates of 7.2 percent and 3 percent, respectively.

These figures underscore the resilience and importance of remittances as a vital financial lifeline for many countries.

The Remittance to Vietnam Context

Vietnam, as one of the emerging economies in Southeast Asia, has a significant share of its population living and working abroad.

The inflow of remittances to Vietnam plays a crucial role in supporting local families, boosting the domestic economy, and fostering financial inclusion.

For cross-border payment companies, this burgeoning market offers a strategic opportunity to expand their services and tap into the growing demand for “Faster – Safer – More cost-effective” remittance solutions.

Opportunities for Cross-Border Payment Companies in Vietnam

1. Enhanced Digital Payment Solutions

As remittance flows continue to rise, there is a growing need for streamlined and secure digital payment platforms.

Cross-border payment companies can leverage advanced technologies such as blockchain, artificial intelligence, and machine learning to offer seamless and transparent transaction processes.

By providing user-friendly interfaces and robust security measures, these companies can attract a larger customer base and build trust among users.

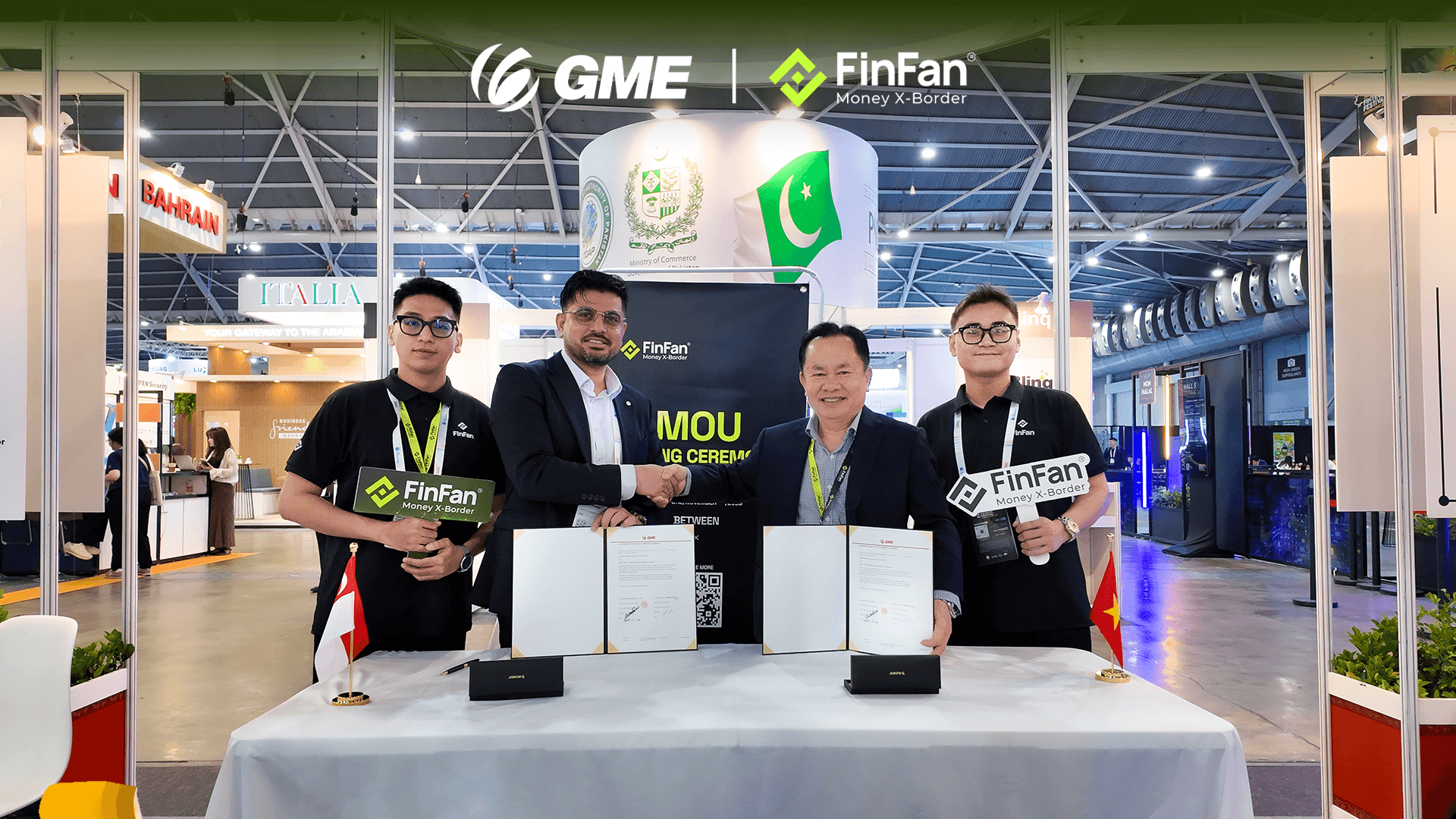

2. Partnerships and Collaborations

Collaborating with local banks, financial institutions, and fintech startups can help cross-border payment companies strengthen their market presence.

By forming strategic partnerships, these companies can offer integrated services that cater to the diverse needs of remittance senders and recipients.

Just like FinFan always tries to find the best way to get in touch with international cross-border payment partners like Remitly, Sendwave, Ria Money Transfer, MoneyGram, etc., and domestic big banks through the NAPAS system or big e-wallet providers like MoMo, ZaloPay, VNPay, etc., to bring the “Faster – Safer – More Cost-effective” way to make remittances to Vietnam for overseas Vietnamese around the world.

Joint ventures can also facilitate access to new markets and customer segments, driving business growth and profitability.

However, startups need to carefully select venture capitalists who can provide sincere advice and closely monitor the company's activities throughout the investment period.

This helps avoid situations where VCs only invest money without offering valuable guidance, such as acting as a mentor or advisor to the business.

In the early stages, companies greatly benefit from the consultation of investment fund experts to successfully execute their long-term plans.

Read more:

. Startup Seed Funding Part 3 - What do startups need after startup seed funding?

3. Targeted Marketing and Customer Education

Effective marketing strategies and customer education initiatives are vital in promoting the benefits of digital remittance services.

Cross-border payment companies can invest in targeted advertising campaigns, social media outreach, and community engagement programs to raise awareness about their offerings.

Educating customers on the advantages of digital remittances, such as lower fees, faster transactions, and enhanced security, can foster greater adoption and loyalty.

4. Regulatory Compliance and Innovation

Navigating the regulatory landscape is essential for cross-border payment companies to operate successfully in Vietnam.

Staying abreast of local regulations, compliance requirements, and industry standards ensures smooth operations and builds credibility with regulatory authorities.

Additionally, continuous innovation in product offerings and service delivery can set companies apart from competitors and position them as leaders in the remittance market.

Conclusion Regarding Chances to Cross-Border Payment Companies in Vietnam When Remittances to Low- And Middle-Income Countries Reached 669 Billion USD

The impressive growth in remittances to low- and middle-income countries presents a golden opportunity for cross-border payment companies in Vietnam.

By embracing digital transformation, forging strategic partnerships, implementing effective marketing strategies, and ensuring regulatory compliance, these companies can capitalize on the expanding remittance market.

As Vietnam continues to integrate into the global economy, cross-border payment companies have a pivotal role in facilitating financial inclusion and driving economic progress.

This article was curated and authored by FinFan's market research and development team, alongside our marketing department.

About FinFan

FinFan is a cross-border embedded financial services company that focuses on mass disbursement, fund collection, card processing, IBAN, and digital APMs solutions, which can provide valuable input and integration on and for the same.

FinFan is already integrated with almost the world's well-known MTOs, PSPs, switch, and core fintech platforms such as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal, Ripple, TripleA, FoMo Pay, Wings, etc.

For more information, please get in touch with us through:

🌐https://finfan.io

📞(+84) 2866 85 3317

✉ support@finfan.vn

LinkedIn: FinFan