There Will Be 50 Million E-Wallets Operating in the Vietnamese Market This Year (2024) - Opportunities or Challenges for the Cross-Border Payment Industry

---Opportunities-or-Challenges-for-the-Cross-Border-Payment-Industry.jpg&w=3840&q=75)

Nowadays, paying by e-wallet has become very familiar to Vietnamese people as the number of people using this type of online payment has been increasing in recent years.

According to the latest statistics from FiinGroup, by the end of 2024, the number of e-wallets in Vietnam will reach 50 million (nearly half of the Vietnamese population and an increase of up to 38% compared to 2023).

Will this become an opportunity for Vietnam's cross-border payment industry, or is it a new challenge awaiting startups in this field? Let's find out with FinFan in the following article.

Overview of Vietnam e-wallet market share in 2023

With very effective support from the State Bank, non-cash payments are increasingly popular nationwide with 58% of Vietnamese consumers paying via credit or debit card, 55% pay via e-commerce platforms, 47% pay on online banking websites, 67% e-wallets or pay by QR code, 44% via online banking applications on phones.

In particular, the e-wallet industry marked strong development, specifically by the end of 2023, the number of active e-wallets was 36.23 million (accounting for 63.23% of the total of nearly 57 31 million e-wallets have been activated), with a total amount of money on these wallets of about 2.96 trillion VND.

Read more:

Among them, the super application MoMo is the unit with the leading market share of e-wallet users nationwide.

The cross-border payment industry in Vietnam gets benefit from the growing e-wallet market

Discussing more about numbers shows the speed of development of the cross-border payment industry.

A 2021 Decision Lab survey found that over three months, 70% of respondents said they used online banking to make payments, followed by cash (63% of respondents) and 61% used a bank account, ATM card, or bank transfer.

According to Robocash research, Vietnam's FinTech market is predicted to reach USD 18 billion by 2024. This represents a significant change in Vietnam's financial services sector, where payment innovations are faster and cheaper surpassing traditional payment methods.

And now, Vietnamese consumers and businesses are demanding a more robust payment infrastructure to facilitate cross-border transactions that can support payments in multiple currencies.

Opportunities for companies involved in cross-border payments to expand their market.

The development of e-wallet companies and many forms of online payment has created favorable conditions for fintech startups related to cross-border payment to expand the market and have more development options. Developing other products for the Vietnamese market and international businesses and investors related to the Vietnamese market. One of those examples is the e-wallet aggregator product that is being deployed and developed quickly.

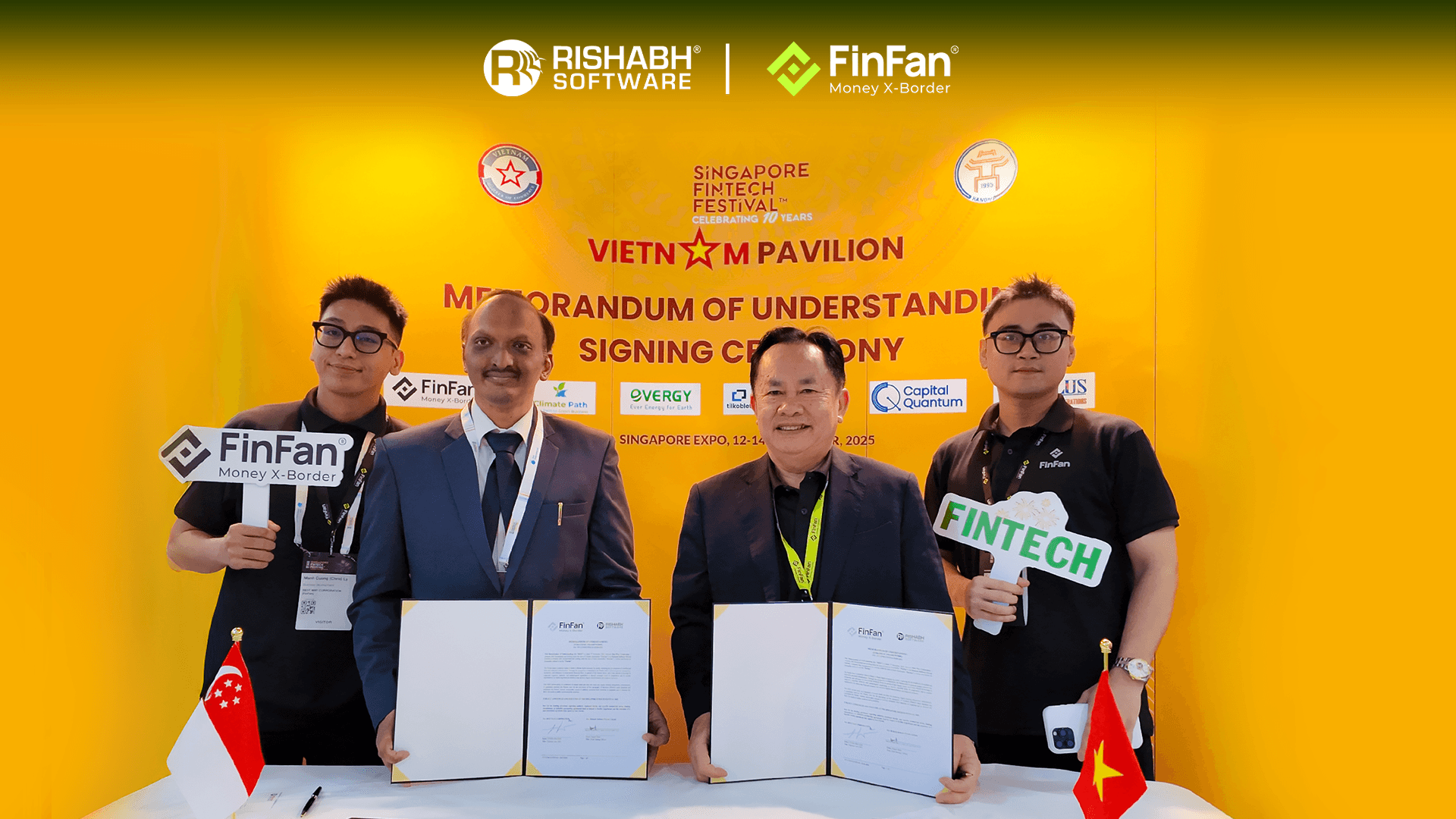

Through the operating model of this product, international businesses, investors, individual users, etc. can transfer money directly from international bank accounts directly to e-wallet accounts. of the recipient in Vietnam, from there, the recipient can use that money to pay for daily bills in Vietnam or pay for some other purposes. One of the pioneering businesses that is effectively applying this product model is FinFan.

With the advantage of being a financial technology service company authorized by the Central Bank to issue License No. 973 on Foreign Currency Acceptance and Payment.

FinFan's tech and market research team has been researching, testing, and launching the first version of the product supporting the connection of all e-wallets in 2021.

Up to now, after nearly 3 years of developing and upgrading the system, FinFan, our international online remittance and domestic e-wallets partners have supported many customers with a faster, easier transfer, and safer cross-border payment method through successfully deploying more than 300 thousand successful transactions direct to e-wallets. One of them comes from the cooperation between Remitly, FinFan, and the super app MoMo.

Receive international money to Vietnam through MoMo - a service jointly implemented by MoMo, FinFan, and Remitly

Realizing the huge potential in the market, FinFan has cooperated with MoMo to deploy a model of receiving international money from other countries to Vietnam through FinFan's international partners, one of them is industry giant online cross-border payment industry – Remitly.

Now, relatives and friends living abroad can transfer money directly to the domestic recipient's MoMo super app account in just 3 steps:

Step 1: The recipient sends information to relatives abroad to log in to the sender's Remitly account.

🖥 On computer: Via website: https://www.remitly.com/

📱 Download the app on the app store:

o Appstore: search for the keyword Remitly

o Google Play: search for the keyword Remitly

Step 2: Make a money transfer order, then enter recipient information and select MoMo payment method (information must match the recipient's phone number registered for the MoMo account).

Step 3: Complete the money transfer order and the money will be transferred directly to the recipient's MoMo account.

About Remitly

Remitly is a digital money transfer service with a mission to make the money transfer process faster, more transparent, and affordable. Because we're a digital service with no physical headquarters, we're able to reduce operating costs so your senders benefit from it.

Remitly helps millions of immigrants around the world who have made enormous sacrifices by leaving their families behind to live and work in another country. These unsung heroes fulfill their promise to care for those they love and give them the ability to advance, improving their quality of life.

Remitly works hard to help their hard-earned money reach further and further so that more people can safely reach their loved ones.

About MoMo

With more than 30 million users, MoMo is the leading super application in Vietnam, the first Vietnamese Fintech to achieve PCI DSS International Security Certification version 4.0 (the highest global standard security level today) and is the only great representative of Vietnam in the Top 50 Fintech in the World voted by KPMG in 2019, and became the first technology unicorn in the Fintech industry in Vietnam in 2021. MoMo's super application ecosystem serves a variety of needs in Vietnamese people's daily lives such as shopping, entertainment, watching movies, traveling, dining, e-commerce, telecommunications, insurance, public services, financial services, volunteering,... Fast, convenient, and safe. The whole world is in your hands, just one touch!

Challenges for companies involved in cross-border payments to expand their market.

The growing number of e-wallet accounts also brings some challenges to businesses involved in cross-border payments, as it forces:

- These businesses must continuously upgrade their systems

User growth forces e-wallet businesses to develop their core technology systems to be able to provide customers with the most service experiences possible.

A typical example is the story of MoMo when they went from just a service specializing in providing phone cards to an e-wallet and until now a super application specializing in finance, able to support customers in solving all kinds of problems related to domestic and international payments.

Therefore, businesses like MoMo must also find reputable partners and continuously upgrade themselves to be able to bring the best payment experiences to users.

- Close cooperation with international partners

Expanding market share to payment via e-wallets will create more problems for international partners as they now also have to update their systems and transaction flows for payment channels. this new.

Furthermore, they do not know much about the Vietnamese market or promptly update some incentive programs from Vietnamese partners.

At this time, businesses involved in cross-border payments need to support international partners in quickly updating incentives from Vietnam and provide additional support in communicating those events to international partners as well as partners from Vietnam.

- More rigorous and updated checks on sender and receiver KYC and AML systems

Although partners from Vietnam and internationally will carry out the KYC and AML steps from both the recipient's side.

However, as an intermediary, it is very important to once again check the issues related to the origin of the sender and recipient of the money.

Especially when the number of people using e-wallets is increasing, it is easy for system errors to occur, and money transfer fraud tricks are becoming more and more sophisticated like today's by individuals and organizations.

Read more:

. 3 compliance pitfalls fintech cross-border payment companies must avoid in 2024.

Some suggestions from FinFan so that businesses involved in cross-border payments can overcome the above challenges.

With nearly 10 years of experience as an extension arm for fintech companies around the world in supporting them to access the Vietnamese market, FinFan always:

Update new market trends of fintech according to market needs.

Currently, FinFan is proud to be one of the pioneers in creating an e-wallet aggregator to link domestic e-wallets, while also creating a premise to connect with units to transfer money to Vietnam quickly so that international partners can reach the most Vietnamese people (36.23 million users).

Follow guidance and news updates from the government on fintech-related issues.

As mentioned in the previous article about the opportunities and challenges of the fintech industry, FinFan is one of 49 businesses licensed to operate in the field of collection and payment support services when licensed by the Central Bank - Foreign currency acceptance and payment license No. 973.

During 10 years of operation, we have always tried to be a bridge between international and domestic fintech companies on legal issues related to the above field through FinFan's Newsroom section to help them make appropriate decision for market development and comply with the directives of the State Bank of Vietnam (especially directives on KYC and AML).

About FinFan

FinFan is a cross-border embedded financial services company, focused on mass disbursement, collection, card processing, IBAN, and digital APM solutions, able to provide valuable input and integration above and for the same purpose.

FinFan has integrated with the most famous MTO, PSP, switch, and core fintech platforms in the world such as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal , Ripple, TripleA, FoMo Pay, Wings or MoMo.

For more information, visit:

🌐https://finfan.io

📞(+84) 2866 85 3317

LinkedIn: FinFan