The Strong Rise of the Payment Methods in Vietnam

Recently, the UK-based financial news site Finextra published articles praising the development of payment technology in Vietnam.

They noted that this S-shaped country has been rapidly adopting almost all of the latest technologies in payments, not only for domestic use but also in the international market.

Addressing this topic, FinFan published an in-depth analysis of the various stages of development of payment technology in Vietnam.

The analysis highlighted how Vietnam's QR code payment technology has expanded to other Southeast Asian countries such as Cambodia, Laos, and Thailand. Read more information about this event here.

In this article, let's analyze the current state of payment technology development in Vietnam based on the data collected by Finextra and provide our own insights on the matter.

The Rise of E-Wallets and QR Codes

The Rise of E-wallets

One of the most prominent trends is the explosion of e-wallets like MoMo, ZaloPay, and ViettelPay.

These applications not only enable users to make quick transactions but also integrate a variety of other services such as bill payments, ticket purchases, and money transfers.

QR Payment and Its Effect on the Payment Behavior of Vietnamese People

In particular, QR code payments have become a popular method, appearing everywhere from convenience stores to traditional markets.

Furthermore, with the current economic integration among ASEAN countries, Vietnam's QR code payment system is fully capable of facilitating cross-border transactions between these nations and Vietnam, or vice versa.

It is evident that although QR codes have only been researched and developed in Vietnam for just over 7 years (since 2017), they have made remarkable strides in the Vietnamese market.

QR codes have gradually become a popular payment method, allowing for convenient transactions at restaurants, grocery stores, hair salons, and more, all with just a few taps on a smartphone.

Why Do Payment Technologies Like E-Wallets and QR Payments Have Exceptional Growth Potential in Vietnam?

Payment technologies like e-wallets and QR payments have the opportunity to develop rapidly in Vietnam due to several key factors:

- Widespread Smartphone Adoption: With the rapid increase in smartphone usage, particularly in urban areas, Vietnamese consumers have greater access to and can easily utilize digital payment services.

- Demand for Convenient and Fast Payments: Vietnamese consumers tend to seek quick, convenient, and secure payment methods. E-wallets and QR payments perfectly meet this demand by enabling transactions in just a few seconds.

- A Dynamic Fintech Ecosystem: Vietnam boasts a rapidly growing fintech ecosystem, with numerous startups and tech companies investing in and developing modern payment solutions, fostering an environment of continuous competition and innovation.

- Changing Consumer Habits: Vietnamese people, especially the younger generation, are gradually shifting their consumption habits from using cash to electronic payments, creating significant opportunities for the robust development of digital payment technologies.

- And the most important is the Support from the Government and Banks: The Vietnamese government and banks are strongly promoting digital transformation and cashless payments. Supportive policies and incentive programs for using electronic payments have created favorable conditions for the growth of these technologies.

Cross-Border Payments and Cryptocurrency

Where Does the Development of Cross-Border Payments to Vietnam Come From?

Cross-border money transfers are becoming increasingly popular, especially as Vietnam's economy integrates more deeply into the global market.

Cross-border payment solutions are rapidly evolving, helping users conduct international transactions quickly and efficiently.

The development of cross-border payment services to Vietnam is driven by several key factors:

- Strong Economic Growth: Vietnam has experienced impressive economic growth in recent years, which has boosted the demand for cross-border payment services to support international trade and investment activities.

- International Economic Integration: Vietnam's active participation in free trade agreements (FTAs) and international economic organizations has increased the volume of international transactions and the need for cross-border payment solutions.

- Rising Foreign Investment: Vietnam has attracted numerous foreign investors, and multinational companies are expanding their operations in the country. The increase in international investment has led to a higher demand for convenient and secure payment methods for international transactions.

- Advancement in Technology and Fintech: The rapid development of financial technology and fintech companies has provided innovative and efficient cross-border payment solutions, optimizing transaction processes and reducing costs.

- Enhanced Regional Connectivity and Cooperation: Regional cooperation agreements and initiatives, such as those within ASEAN, have facilitated the development of cross-border payment services, reducing barriers and promoting financial transactions within the region.

- Demand from the Vietnamese Diaspora: The growing number of Vietnamese expatriates living and working abroad has created a significant demand for remittance services and cross-border payments to their home country. This has driven the development of cross-border payment services.

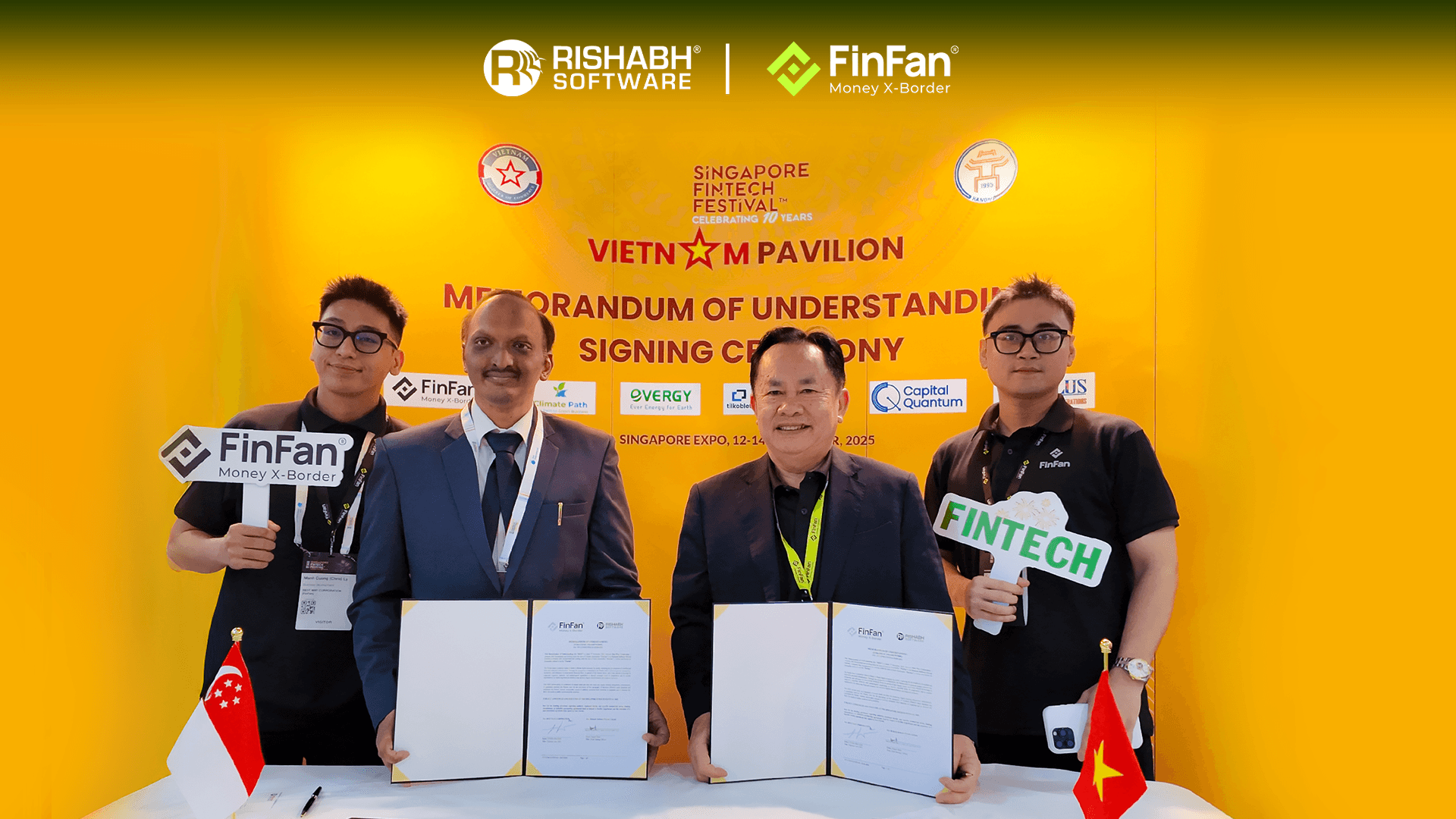

Solution for the Development of Cross-Border Payments to Vietnam from FinFan

With the mission of providing a "Faster - Safer - More Cost-Effective" cross-border payment experience to Vietnam, FinFan has continuously researched and applied the latest technologies.

This enables us to effectively integrate with international cross-border money transfer partners and local payment partners in Vietnam, such as banking systems and e-wallets.

Especially, we are a pioneer in the field of integrating e-wallets in Vietnam into a unified system called the "ewallet aggregator". This system supports users in Vietnam by enabling them to receive cross-border payments into any e-wallet that is connected with us.

Currently, FinFan is supporting international businesses specializing in cross-border money transfer services to Vietnam through remittance solutions.

With these solutions, senders can execute money transfer orders via the transaction apps or service locations of partners like MoneyGram, Ria Money Transfer, Sendwave, Remitly, Paysend, and others associated with FinFan.

Recipients in Vietnam can receive money through three methods:

- cash pickup at a counter,

- direct transfer to a recipient's bank account,

- or direct transfer to e-wallets such as MoMo, ZaloPay, VNPay, Viettel Money, VNPT Money, and more.

Note: For the "Direct Transfer to E-Wallet" method, it is important to note that currently only Sendwave does not offer this service.

Cryptocurrency

At the same time, cryptocurrency is emerging as a new and promising payment channel, with the rise of on/off-ramp solutions combined with e-wallets and fintech platforms.

The Vietnamese market is inherently open and promising for fintech companies involved in cryptocurrency, as users in this country are highly dynamic, innovative, and receptive to new international technologies.

This has been demonstrated through various indicators, including the acceptance of cryptocurrencies, ownership of cryptocurrencies as digital assets, and the profitability of cryptocurrency investments in Vietnam.

The Road Ahead for Payment Technology of Vietnam

Vietnam's journey in the payment technology sector is far from over. With international recognition and regional expansion already underway, the country is poised to further enhance its capabilities and continue setting new standards in the global fintech arena.

The future looks promising, with potential developments in blockchain, AI, and cross-border fintech partnerships likely to play a crucial role in shaping the next phase of Vietnam's digital economy.

As Vietnam continues to innovate and expand its payment technology solutions, it sets a powerful example for other developing nations looking to leapfrog into the digital future.

The recognition from platforms like Finextra and the insights from industry player like FinFan are not just accolades; they are indicators of the significant impact that Vietnam is making on the world stage.

Conclusion Regarding the Strong Rise of the Payment Methods in Vietnam

In conclusion, Vietnam's rise in the payment technology sector is a story of ambition, innovation, and strategic growth.

As the country continues to evolve and integrate new technologies, it will undoubtedly remain a key player in the global fintech landscape, driving progress and inspiring others along the way.

This article was curated and authored by FinFan's market research and development team, alongside our marketing department.

About FinFan

FinFan is a cross-border embedded financial services company that focuses on mass disbursement, fund collection, card processing, IBAN, and digital APMs solutions, which can provide valuable input and integration on and for the same.

FinFan is already integrated with almost the world's well-known MTOs, PSPs, switch, and core fintech platforms such as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal, Ripple, TripleA, FoMo Pay, Wings, etc.

For more information, please get in touch with us through:

🌐https://finfan.io

📞(+84) 2866 85 3317

✉ support@finfan.vn

LinkedIn: FinFan