The Impact of the New Government Circular in Vietnam on Payment Accounts for Businesses

The Impact of the New Government Circular in Vietnam on Payment Accounts for Businesses

Vietnam has been at the forefront of digital transformation in Southeast Asia, with rapid advancements in its financial and technological sectors.

To maintain a secure, transparent, and efficient financial ecosystem, the Vietnamese government has introduced a new circular, effective from July 1st.

This regulation impacts how businesses manage their payment accounts. In this blog, we explore the key aspects of the circular and its implications for businesses payment accounts in Vietnam.

Key Objectives of the Circular

The new government circular is designed to address several critical areas within the financial ecosystem:

- Enhancing security measures

- Promoting transparency and accountability

- Encouraging the adoption of digital payment methods

- Ensuring compliance with international standards

By focusing on these areas, the government aims to create a robust framework that supports economic growth, safeguards against financial crimes, and fosters innovation in the financial sector.

Major Changes and Requirements

Enhanced Security Protocols:

The circular mandates stricter security protocols for payment accounts. Businesses are required to implement advanced encryption methods and multi-factor authentication to protect against cyber threats.

This is crucial in an era where cyberattacks are becoming increasingly sophisticated and frequent.

Increased Transparency and Reporting:

Businesses must now maintain detailed records of all transactions. Regular audits and reporting to regulatory bodies are mandatory.

This measure aims to reduce the risk of fraud and money laundering, ensuring that all financial activities are traceable and accountable.

Promotion of Digital Payments:

The government is encouraging businesses to adopt digital payment methods by offering incentives and support.

This shift is expected to reduce reliance on cash transactions, thereby increasing efficiency and reducing costs associated with handling physical money.

Compliance with International Standards:

Aligning with global best practices, the circular ensures that Vietnam's financial system is in harmony with international standards.

This is particularly beneficial for businesses engaged in international trade, as it simplifies cross-border transactions and enhances credibility.

Implications for Businesses Payment Account in Vietnam

The new circular and policies from the State Bank of Vietnam will have a more significant impact on individual transaction accounts than on business payment accounts.

This is because business transactions are already subject to stringent legal procedures and specific invoices and documentation.

However, businesses still need to take the following actions to best support their customers.

1. Enhance Security Measures

Although business transactions are already secured through various legal and procedural means, the new circular emphasizes further strengthening security protocols. Businesses should:

Implement Advanced Encryption: Ensure all transaction data is encrypted to prevent unauthorized access.

Adopt Multi-Factor Authentication (MFA): Require additional verification steps for accessing business accounts to add an extra layer of security.

2. Maintain Detailed Transaction Records

Even though businesses typically maintain detailed records, the new circular mandates more rigorous documentation and reporting. To comply:

Regular Audits: Schedule frequent internal audits to ensure all transaction records are accurate and up to date.

Detailed Reporting: Prepare to provide comprehensive reports to regulatory bodies as required, ensuring transparency and traceability of all transactions.

3. Promote Digital Payment Methods

The government is pushing for the adoption of digital payment methods to reduce reliance on cash and improve transaction efficiency. Businesses can support this initiative by:

Offering Incentives for Digital Payments: Provide discounts or rewards for customers who use digital payment methods.

Educating Customers: Inform customers about the benefits of digital payments, such as convenience, speed, and security.

4. Compliance with International Standards

Aligning with international financial standards will benefit businesses involved in global trade. To achieve this:

Adopt Best Practices: Implement globally recognized financial practices and standards within the business.

Train Staff: Provide training for employees on international compliance requirements to ensure smooth operations across borders.

5. Support for Customers

To ensure customers are not adversely affected by the new policies, businesses should:

Customer Service Enhancements: Improve customer support services to assist customers with any issues related to the new payment processes.

Clear Communication: Keep customers informed about any changes in payment processes and how these changes will benefit them.

Conclusion Regarding the Impact of the New Circular by the State Bank on Business Payment Accounts

While the new circular by the State Bank of Vietnam primarily affects individual transaction accounts, businesses must still take proactive steps to comply with the new regulations and support their customers.

By enhancing security, maintaining detailed records, promoting digital payments (like open virtual digital payment accounts), complying with international standards, and improving customer support, businesses can navigate the new regulatory landscape effectively and continue to thrive in a more secure and efficient financial environment.

This article was curated and authored by FinFan's market research and development team, alongside our marketing department.

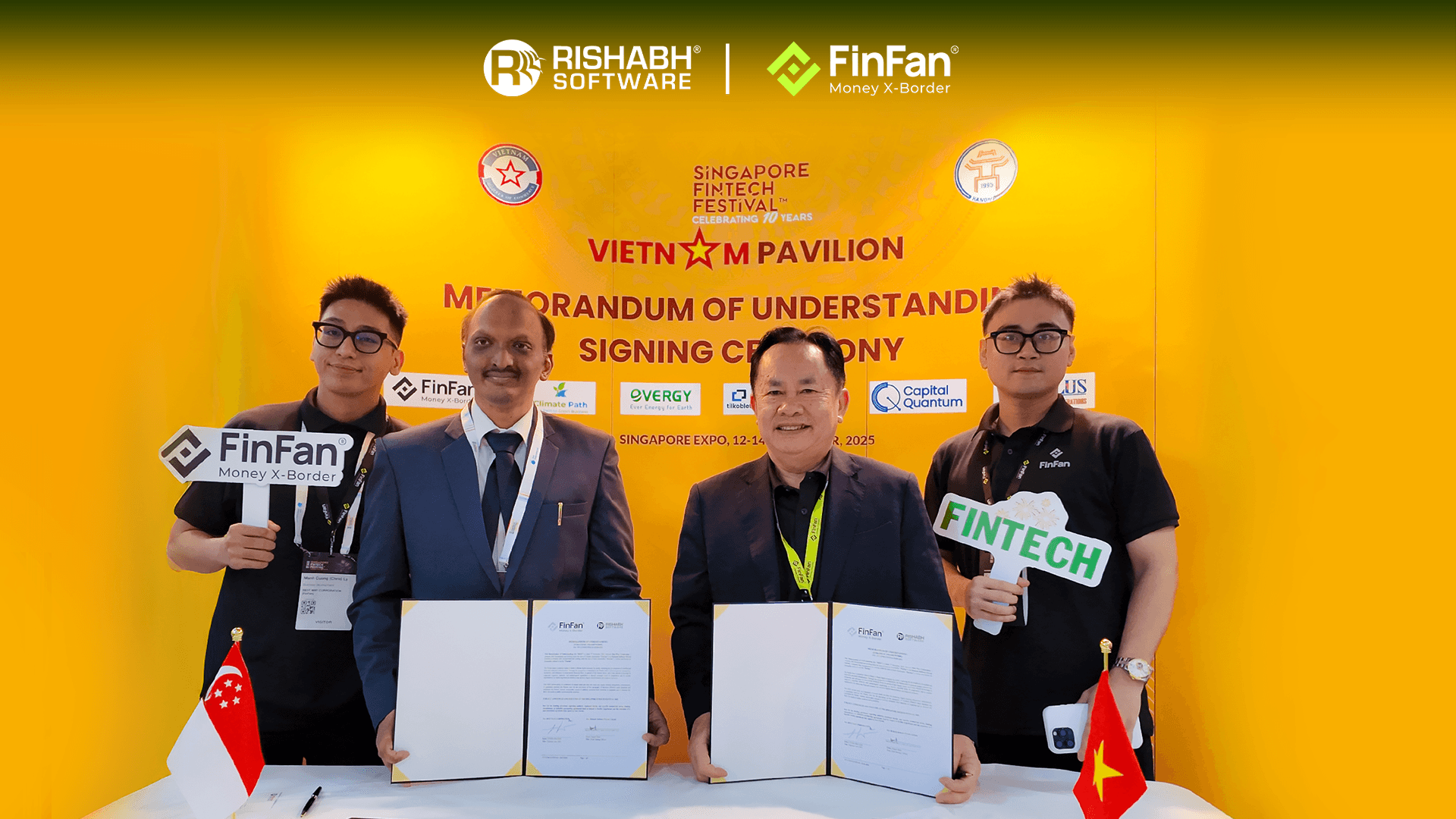

About FinFan

FinFan is a cross-border embedded financial services company that focuses on mass disbursement, fund collection, card processing, IBAN, and digital APMs solutions, which can provide valuable input and integration on and for the same.

FinFan is already integrated with almost the world's well-known MTOs, PSPs, switch, and core fintech platforms such as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal, Ripple, TripleA, FoMo Pay, Wings, etc.

For more information, please get in touch with us through:

🌐https://finfan.io

📞(+84) 2866 85 3317

✉ support@finfan.vn

LinkedIn: FinFan