REMITTANCES TO VIETNAM REACH OVER 600 BILLION VND JUST DURING TET - OPPORTUNITIES AND CHALLENGES FOR VIETNAM'S ECONOMY

According to a reputable source from a reputable online newspaper about Finance and Business - NguoiQuanSat.Vn, the amount of remittances to Vietnam has reached a notable figure of more than 600 billion VND during Tet this year, especially in Central provinces in Vietnam such as Nghe An, Ha Tinh,...

This amount of money mainly comes from labor export forces to countries such as Japan, Korea, Taiwan, etc. and it has greatly supported the improvement of the quality of life of poor rural people in Vietnam.

Even the above remittance money can help change the lives of farmers here when a village in Do Thanh commune, Yen Thanh district, Nghe An suddenly becomes a "billionaire village", making many people unable to be surprised by the wide road, more and more cars appearing, villas growing close together.

Through the above example, it can be said that transferring remittances to Vietnam has created many conditions and development opportunities for people in rural areas.

However, it still leads to some challenges for the fintech technology industry in Vietnam in the coming years. Let's learn about the above issue with FinFan through the following article.

Remittances to Vietnam, an opportunity to improve the lives of rural people

According to information from NguoiQuanSat.Vn, remittances can account for up to 50% of the district's production value. Initially, the amount of remittances sent back from labor exporters was one of the important factors so that families and relatives in Vietnam could first of all manage their essential problems such as living expenses as well as educational expenses for children in the area.

However, because the main occupation of families with relatives working abroad is farming, most food and living expenses are not significant, along with tuition fees in rural areas are not too high.

This leads to the local recipient accumulating a large amount of money for themselves and thereby being able to completely improve the lives of themselves and their families.

And as the flow of remittances increases, people here can build their own houses, buy cars, and even build villas on the land they live on.

A typical example that this information page gives is that Mr. Nguyen Trung's family (in Phu Xuan village, Do Thanh commune) used to be a poor household. As the trend of people going abroad to do business became increasingly popular, Mr. Trung's family boldly borrowed and invested money for his three children to export labor to Western countries.

Stable work in the host country has brought in hundreds of millions of dong each year for the family. With the business money earned from labor export, in recent years, Mr. Trung's family has been able to buy a car, build 3-4 high-rise houses for his children, and family life has "changed dramatically."

Challenges for the Vietnamese economy when the amount of remittances is increasing (especially during Tet)

Challenges for the Vietnamese workforce

As more and more remittances flow to Vietnam from labor export, some families or young people will think that labor export is the only way to improve their lives. From there, young people will find every way to follow this path of making money.

This will have a huge impact on the country's workforce in the future when:

• Missing out on many talented people because they chase money and don't go to higher education to gain knowledge for other intellectually demanding professions.

• Resource bleeding when there will be fewer people involved in some jobs in industrial parks in Vietnam, thereby leading to a decrease in the quality of domestic production.

• Some forms of illegal labor export appear more and more due to the rapid and large increase in demand.

Challenges of increasing real estate prices in Vietnam

Most of the remittances flowing to Vietnam are invested in other highly profitable channels such as securities, real estate, etc. A recent report on Vietnamnet.vn showed that 25% of remittances Foreign exchange allocated to real estate investment channels has caused housing prices to skyrocket in recent years.

It is noteworthy that the people who receive remittances from labor export mostly come from farming families. Receiving a large amount of money can cause them to stop focusing on agriculture and switch directly to the above investment channels while still having no knowledge about them.

This has led to real estate prices in the provinces and cities continuing to increase sharply in recent years and can lead to people who want to buy real housing not being qualified to own a house and a real estate bubble can break at any time. At that time, the losers will be the investors who have participated in the market (usually those who receive large sums of money from remittances).

Challenges for the fintech technology industry in Vietnam

The need to transfer money to Vietnam will increase every time (especially during Tet) not only in the countryside but also in big cities. The proof is that the amount of remittances to Ho Chi Minh has continuously broken many new records in 2023.

Moreover, the number of people remitting money to Vietnam is increasingly young (in working age) and are regularly updating technology.

At the same time, payment technology in Vietnam is also changing very quickly. Today, young people in Vietnam only need a few mouse clicks and a few operations on their smartphones, or even scanning codes without touching, to be able to pay their daily bills.

Therefore, they need a money transfer channel that can meet a number of conditions such as fast, safe and least expensive, especially during the Tet season when all Vietnamese people have the tradition of giving lucky money.

That also creates an invisible pressure on fintech companies when they are forced to research and create products that can meet the above needs.

To do that, fintech companies must make continuous efforts to update technology and upgrade transaction systems to minimize error situations that can affect service quality.

Besides, they also have to find reputable international partners that can help them realize the above goal.

Technology solutions from FinFan and partners

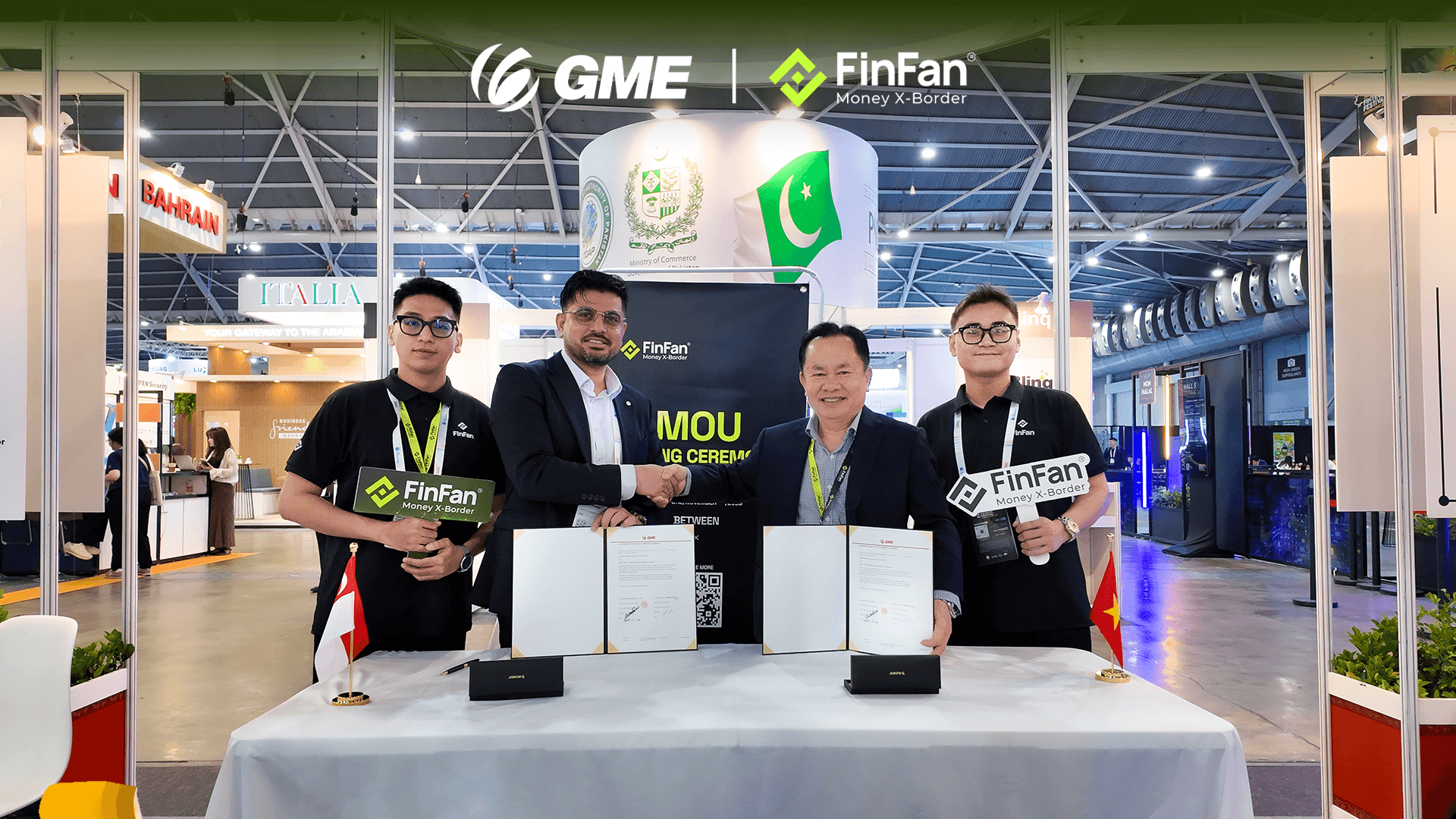

Understanding the problem on FinFan has integrated with most MTO, PSP, switch and core fintech platforms, and we have cooperated with many foreign partners to promote the development of cross-border remittance technology gender.

One of those partners is Ria Money Transfer when FinFan has combined with this unit specializing in remittance money transfer services to Vietnam in all fields of the latest technology including:

- Direct API connection to e-wallet partners through FinFan's e-wallet aggregator system helps users transfer money directly from Ria Money Transfer to MoMo in just 3 steps:

.png)

Step 1: Send information to your relatives abroad to log in to Ria Money Transfer

🖥 On computer: Through the website: https://www.riamoneytransfer.com

📱 Download the app on the app store:

o Appstore: search for the keyword Ria Money Transfer

o Google Play: search for the keyword Ria Money Transfer

Step 2: Make a money transfer order, then enter recipient information and select MoMo payment method (information must match the phone number registered to the reciepient's MoMo account).

Step 3: Complete the money transfer order and the money will be transferred directly to the reciepient's MoMo account.

- Direct API connection to Vietnamese domestic banking partners

FinFan links directly with NAPAS and Citad to support connection of more than 60 domestic banks or branches of international banks in Vietnam. With our collection and payment service, customers' remittances are transferred directly in real-time to the recipient's bank account in Vietnam. From there, the recipient will no longer need to wait several days to receive money from their friends or relatives abroad.

About Ria Money Transfer

With a worldwide network of 507,000 locations in 160 countries, Ria Money Transfer continue to make the world a smaller place by closing distances between families and their loved ones through world-class money transfers.

They also offer bill payment, mobile top-ups, prepaid debit cards, check cashing, and money orders. With every service that they provide, we work hard to provide the most positive experience possible.

This article was curated and authored by FinFan's market research and development team, alongside our marketing department.

About FinFan

FinFan is a cross-border embedded financial services company that focuses on mass disbursement, fund collection, card processing, IBAN, and digital APMs solutions, which can provide valuable input and integration on and for the same.

FinFan is already integrated with almost the world's well-known MTOs, PSPs, switch, and core fintech platforms such as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal, Ripple, TripleA, FoMo Pay, Wings, etc.

For more information, please get in touch with us through:

🌐https://finfan.io

📞(+84) 2866 85 3317

✉ support@finfan.vn

LinkedIn: FinFan