Coins.ph and FinFan Partner to Revolutionize Philippines-Vietnam Remittances with New Technology

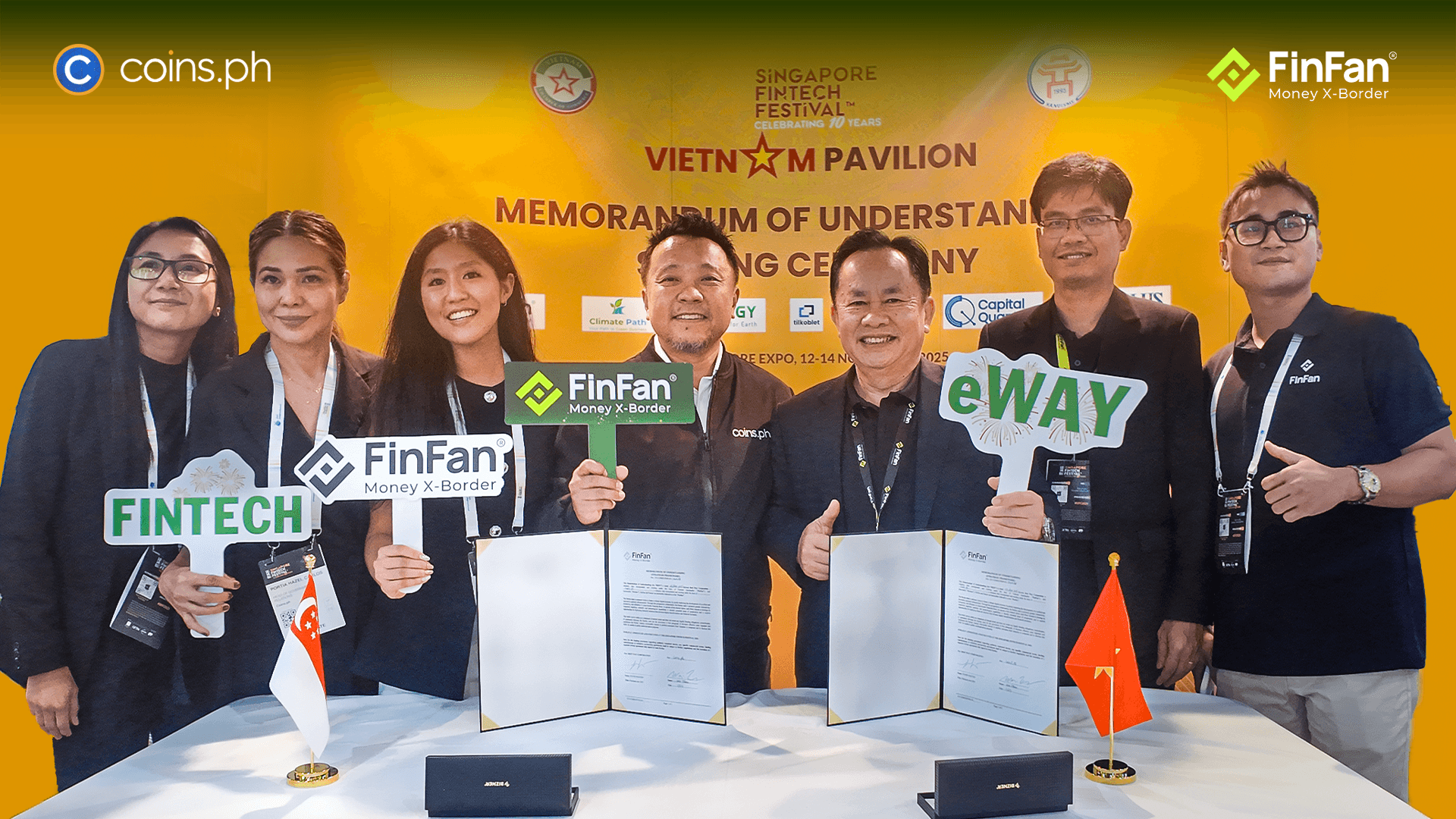

Singapore , November 13, 2025 – Coins.ph, the Philippines’ EMI (Electronic Money Issuer) and EPFS (Electronic Payment and Financial Services)-licensed CEX, and Best Way Corporation (FinFan), a trusted financial technology company based in Vietnam, have signed a memorandum of understanding (MOU) for a strategic partnership to streamline and expand cross-border remittance and payment flows between the two countries. The agreement was signed at the sidelines of the ongoing Singapore Fintech Festival.

Under the MOU, Coins.ph will leverage its licensed infrastructure to independently manage the conversion of funds into USD. These funds are then sent as a standard international fiat remittance to FinFan’s account for local disbursement in USD. This collaboration allows FinFan to enhance its remittance services for individuals, and families,offering a faster, more transparent, and cost-efficient remittance solution. By combining Coins.ph’s capabilities as a licensed Electronic Payment and Financial Services provider and other capabilities with FinFan’s local payout ecosystem, both companies aim to promote financial inclusion and cross-border efficiency across Southeast Asia’s growing digital society.

The partnership is grounded in regulatory compliance as Coins is licensed as both a Virtual Currency Exchange (VCE) and an Electronic Money Issuer (EMI) by the Bangko Sentral ng Pilipinas while FinFan is licensed by the State Bank of Vietnam to provide legal international remittance services. FinFan delivers payment infrastructure solutions for global money transfer operators, banks, and digital platforms.

“Our partnership with FinFan reflects our shared vision of making cross-border money transfers simpler and more inclusive through new technology,” said Wei Zhou, Coins.ph Chief Executive Officer.

“Together, we’re bridging traditional finance and modern financial solutions to support international partners, and remittance recipients across Vietnam and the Philippines,” added Nguyen Tuyen, CEO of FinFan.

This collaboration reinforces both companies’ commitment to innovation in the remittance sector—empowering users with a secure, compliant, and scalable new-tech cross-border infrastructure, which is now estimated to account for about 23% of worldwide remittances.

Industry estimates likewise point to a $250 billion new-technology-driven remittance volume for Asia by the year 2028. The core appeal of this new technology lies in their ability to facilitate transactions with unmatched speed (often in minutes, 24/7), which is often cited as a greater benefit than even the significant cost-efficiency they offer over legacy systems.

About FinFan

FinFan is a licensed fintech company regulated by the State Bank of Vietnam. With strengths in compliance, banking connectivity, and transaction processing, FinFan serves as a bridge between global financial innovation and the Vietnamese banking ecosystem.

FinFan’s mission is to enable faster, safer, and more transparent international transactions for financial institutions through a trusted, efficient, and regulatory-compliant digital payment ecosystem.

About Coins.ph

About Coins.ph Coins.ph is an all-in-one financial app for millions of users in the Philippines. Established in 2014, Coins.ph is licensed by the Bangko Sentral ng Pilipinas (BSP) as an Electronic Money Issuer (EMI), a Remittance and FXD/MC provider, and holds an Advanced Electronic Payment and Financial Services (EPFS) license.. The platform empowers users to utilize its mobile wallet and access a wide range of regulated financial services, including international remittances, for sending and receiving funds quickly and affordably, all in one secure place.

![[Report] Vietnam Financial Outlook 2026: Emerging Trends In Cross-Border Connectivity](/_next/image?url=https%3A%2F%2Fcdn2.finfan.io%3A8443%2Fuploads%2F2025%2F1%2F1768269028296-payfi.png&w=3840&q=75)