Does Vietnam fintech still have a future to grow?

In the 4.0 revolution, technology was the core foundation for the development of traditional professions, especially the financial industry. The fintech industry is also very influential in people's lives.

In this article, let’s find out with FinFan what will promote the development of Vietnam's fintech industry and if Vietnam’s fintech still has a future to grow.

What will promote the development of Vietnam’s fintech industry?

The growth of fintech depends a lot on the industry group that the company is building and the share it can capture in the market.

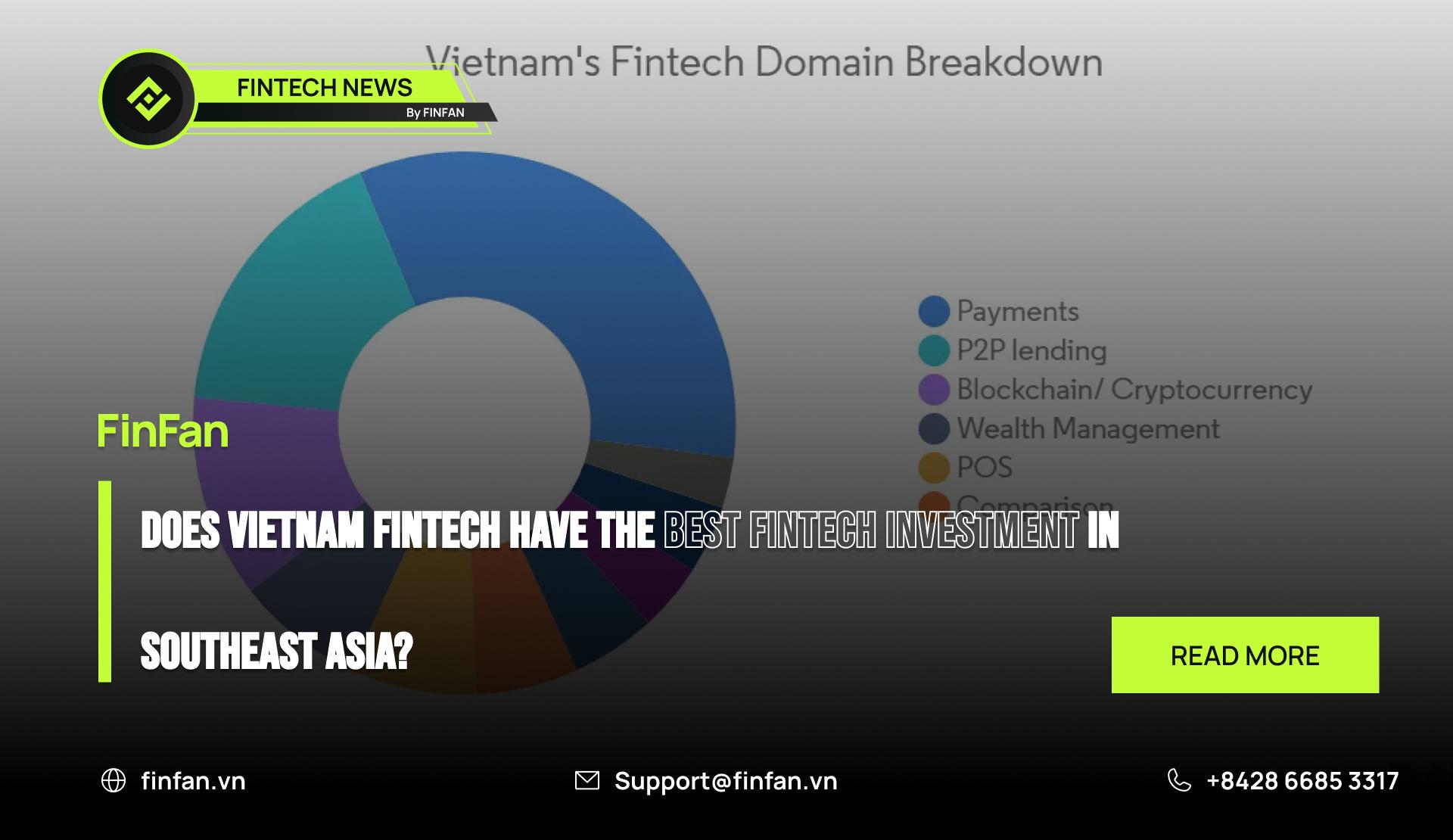

A little look at the market share of fintech industries

- Online/Mobile Payment

According to a report from Vietnam Market Research Report in 2019, MoMo is still the most used ewallet application in the market with more than 68% market share and if calculated until now, this number continues to increase. significantly after MoMo's relentless efforts to attract new customers in the past time.

Even big ewallets or digital banks like Viettel Pay have regretfully ranked second with only an 8% market share. That being said, if a startup firm approaches you with an idea for a mobile payment or online payment project, take it seriously because the enormous MoMo has been estimated to be worth up to $2 billion.

That being said, if a startup firm approaches you with an idea for a mobile payment or online payment project, take it seriously because the enormous MoMo has been estimated to be worth up to $2 billion.

- Peer to peer lending

Peer-to-peer lending is seen as a viable fintech subsegment since it facilitates the connection between peers' borrowing and lending needs without the use of a middleman.

However, there are still several issues with this type, including the law's treatment of loan interest rates and the lender's non-black financial party appraiser.

If there is a founder of this field who wants to ask for investment capital from you, ask him about the legal issues of the startup itself.

- Wealth management

Despite being comparatively new, this industry has recently demonstrated its viability. Despite being a newer industry, this company niche has recently gained market traction.

Despite being a relatively new industry, this business sector has recently demonstrated its viability.

When FinHay goes public in 2017, this market segment is expected to have potential and be able to assist investors in making money with as little as VND 50,000.

After that, a series of companies opened in a similar form: Infina, Tikop, etc. This makes the market almost saturated, and it is very difficult for a new product or service to enter because this market also develops based on traditional investment models such as stocks, bonds, real estate, savings, etc.

In 2020, a company went on a shark tank to raise capital with a completely new model of investing in gold through the app. This model is quite good, but was rejected by the sharks because of concerns that the project would not have enough capital to pay the amount if investors withdraw all the gold.

Recognizing the above potential idea, Finhay has launched a similar service with a new way of doing it, which is to cooperate with famous jewelry companies such as PNJ, SJC, to be able to exchange and pay. gold for investors when they need to withdraw gold.

- Digital bank and NEOBank

After the transformation of top traditional banksin Vietnam has aggressively entered the digital transformation game. At the same time, these banks also actively set up other digital banks to optimize and diversify revenue sources for their own banks.

Therefore, the game of the digital banking industry is almost over and is no longer as attractive to investors as when Timo was first launched in 2016.

In terms of the NEOBanks game, there is still a lot of market share on the cake for investors to jump into, especially companies that provide services associated with foreign countries or have international elements in it.

This article was curated and authored by FinFan's market research and development team, alongside our marketing department.

About FinFan

FinFan is a cross-border embedded financial services company, focused on mass disbursement, collection, card processing, IBAN, digital APM solutions, able to provide valuable input and integration above and for the same purpose.

FinFan has integrated with most famous MTO, PSP, switch and core fintech platforms in the world such as Money Gram, Thunes, Qiwi, Remitly, World Remit, Bancore, PaySend, Terrapay, Ria Money Transfer (Euronet), Dlocal , Ripple, TripleA, FoMo Pay, Wings or Zalo.

For more information please contact us via:

🌐https://finfan.io

📞(+84) 2866 85 3317

✉ support@finfan.vn

LinkedIn: FinFan